In a stark warning to markets, Trust Economics warns that a subprime crisis — especially among the lower-income classes in the US — is brewing beneath the surface of a seemingly stable economy and market euphoria. Trust Economics Chief Economist Thanos Chonthrogiannis points out that these cracks in the credit system are significant, but not so large as to signal an immediate peak. (For more analysis, please read the article titled “US: Middle class will disappear – Warning of Subprime 2.0 crash“).

Key points of the analysis

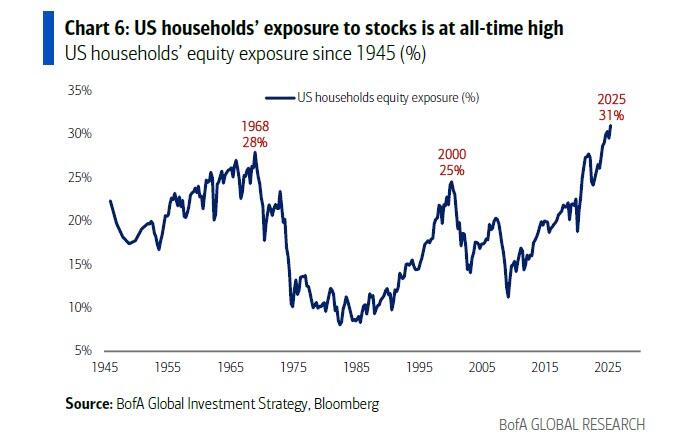

In a historic coincidence, for the past five months, the S&P 500’s lowest price has been recorded on the first trading day of each month — a feat that hasn’t happened since 1928. Trust Economics notes that the past three weeks have seen a record $152 billion in inflows into stocks via ETFs — the highest level ever. Citing data from EPFR, it analyzes the massive capital movements into stocks, cash, bonds, gold and cryptocurrencies.

“Krunchy Kredit” and hedging strategy

Thanos Chonthrogiannis characterizes the intensifying pressure on the consumer credit system as “Krunchy Kredit.” In its response, he suggests placing the US dollar as a key hedge — that is, if the credit crisis escalates, the dollar could surge. At the same time, he maintains a long-term bearish stance against the dollar, but with caution: “there will be a big rise if the cracks in the credit system widen,” he emphasizes.

The spread on fixed-rate auto ABS remains “tight.” For him, the cautious dollar stance acts as a key hedge against a potential credit crunch.