Generally speaking, the Fed’s independence is widely understood and supported in principle in Washington, in Congress, where it really matters.

The point is that decisions should be made based on the best analysis of the data, on how to achieve its dual goal of price stability and employment, as best it can, for the benefit of the American people.

This, of course, is clearly false, although many tears… are shed in its favor…

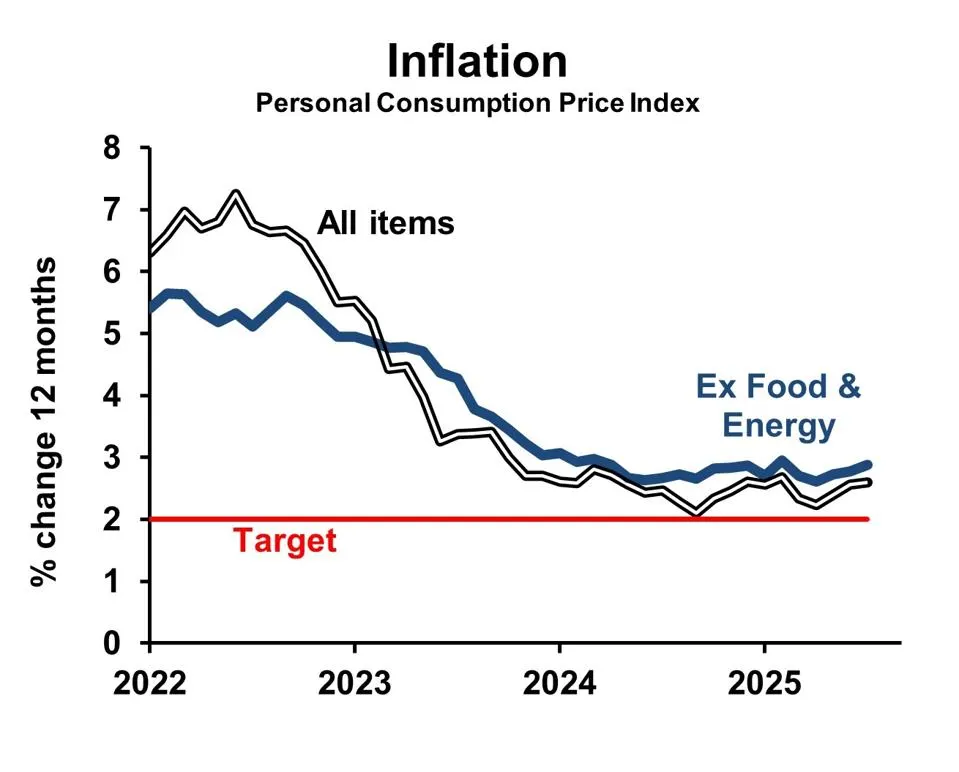

First, the Fed interprets the “price stability” part to mean that it should aim for 2% annual price inflation, as measured by various official statistics. Thus, the Fed feeds the political power machine in Washington, hiding the cost of government spending.

At the same time, it has failed in its supervisory role, as seen in the 2008/2009 financial crisis and subprime mortgages, the dollar is inflationary (it has lost too much of its value in order to expand the monetary base), while millions of Americans are out of the employment system and are fed by “food banks”.

The Fed seems to serve the government more than the American people. This is known… even by those who tear their clothes for the independence of the central bank.

All of this is supported by the Trump administration, which wants to make significant changes to the operation of the Fed.

Stephen Miran’s role in data overturning

White House economic adviser Stephen Miran is one of Donald Trump’s key “strategists” in curtailing the Federal Reserve’s autonomy and pursuing a paradigm shift in the economy.

The president is giving him the opportunity to turn the central bank inside out. The Harvard-trained economist, who was tapped by Trump for a seat on the Fed’s board, has proposed

- measures that would allow the president to fire Fed governors at will.

- He wants to end the inflation-targeting policy that sets price expectations and has criticized the “incredibly inappropriate” government debt markets for sound monetary policy during economic booms.

- He has even challenged traditional notions of central bank independence.

The Senate Banking Committee is expected to hold a hearing on Miran’s nomination as early as next week, and the White House is pushing Republican senators to hold a confirmation vote in time for the Fed’s September meeting.

If Miran joins the board, his wide-ranging criticisms would make him a rare dissenter at an agency that purports to seek consensus and stability.

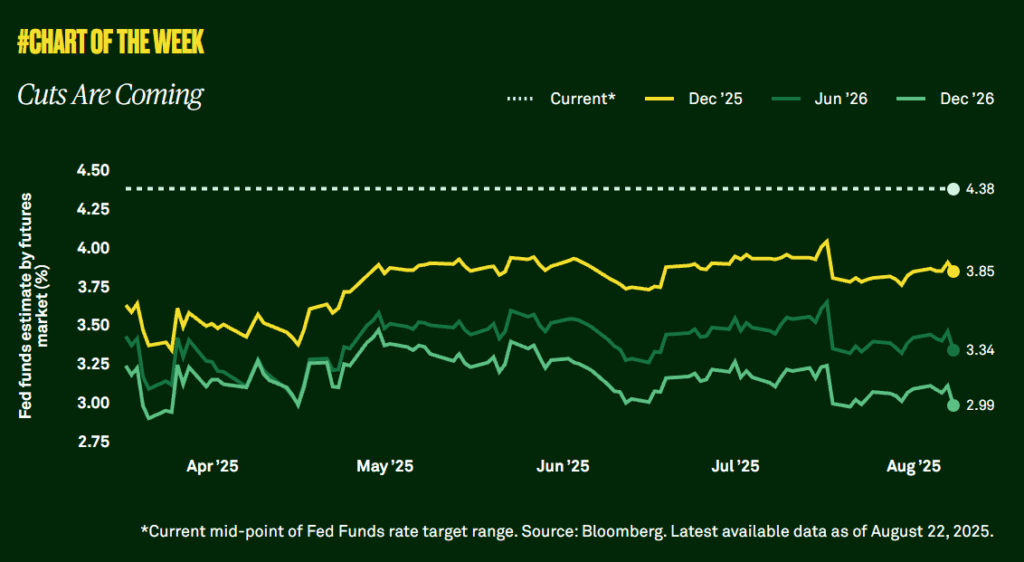

It would also be a major step in Trump’s efforts to gain greater control over the Fed, in his bid to lower interest rates to boost economic growth and reduce the fiscal burden of servicing the country’s massive debt.

Trump says the president should have a say in setting interest rates, and his efforts to pressure Fed Chairman Jerome Powell to lower borrowing costs — along with an unprecedented push to fire Lisa Cook — are widely seen as attempts to exert political influence over the central bank. The prospect is said to be worrying people inside and outside the Fed.

Stephen Miran’s proposals would create “a much more politicized central bank.” Critics of Trump’s moves worry that a more political Fed would make interest rate decisions based on short-term considerations to support the economy rather than long-term price stability.

Miran, a former hedge fund investment manager, would fill the vacancy created by the unexpected resignation of former board member Adriana Kugler just six months before her term ended.

However, if Trump succeeds in removing Cook for cause, that could give Miran a longer term at the Fed.

Trump appeared to hint on Tuesday that Miran, as chairman of the Council of Economic Advisers, could replace Cook, whose term ends in 2038. “We may move him to the other position — it’s a longer term,” the president said at a Cabinet meeting.

Democratic Senator Elizabeth Warren has already pledged to scrutinize Miran for “whether he will serve the American people as an independent voice at the Fed or whether he will simply serve Donald Trump.”

And after Trump announced his plans to fire Cook — who has sued him, claiming his actions were “unprecedented and illegal” — the progressive organization Employ America began distributing opposition memos to lawmakers highlighting Miran’s positions on the dollar and Fed independence.

How is Miran’s plan unfolding?

Miran’s writing as a senior fellow at the Manhattan Institute, along with his analysis as a senior strategist at the investment firm Hudson Bay Capital, focuses primarily on the economic implications of fiscal and monetary policy. He has written extensively on issues involving the Fed.

He has written frequently about interest rate decisions, often adopting a “hawkish” stance — that is, keeping interest rates high — even as inflationary pressures and financial conditions eased after the pandemic.

He is also a well-known skeptic of a strong dollar: a post-2024 election essay on a possible “Mar-a-Lago Accord” that would convert government debt into longer-term bonds and weaken the dollar was widely cited by Wall Street traders as a possible blueprint for Trump’s agenda.

For central bank watchers, his essay last year calling for changes to give the president direct control over monetary policymakers was even more impressive.

The proposals included shortening governors’ terms from the current 14 years — seen as a safeguard against political interference — and handing responsibility for the 12 regional banks to state governors, who also participate in setting monetary policy.

With Dan Katz — also a Manhattan Institute graduate and now chief of staff at the Treasury — Miran also proposed changes that would subject the Fed to the standard government appropriations process, give Congress control over its budget; make it easier to fire permanent staff; and allow regional bank heads to vote at every meeting of the Federal Open Market Committee.

Miran and Katz argued that their proposals — which would require significant changes to the Federal Reserve Act, the Fed’s operating rules — would give lawmakers more influence over the institution and empower state governments in a way “likely commensurate with the existing political balance.”

Crucially, giving each regional bank a vote on monetary policy would “limit the ability of the U.S. president to completely dominate the FOMC.”

Recent, binding court decisions have limited the power of independent regulators, they noted, and the proposed changes are intended to “ensure that the Fed can operate with the independence necessary to set effective monetary policy while being accountable to democratic institutions.”

However, as John Cochrane, a fellow at the Hoover Institution, wrote in a recent blog post, “putting Fed officials under the President’s control would mean more… politics.”

Miran’s Criticism

There is broad consensus among conservatives that the Fed’s post-crisis bond purchases to support the economy have blurred the line between fiscal and monetary policy — something Miran has repeatedly pointed out.

As for his proposal to scrap the 2% inflation target, there are calls across the spectrum of economists for a rethink of the inflation-fighting framework.

The question is whether Miran is the right person to do it.