President Donald Trump’s trade war with retaliatory tariffs is accelerating Beijing’s trade and investment push toward developing countries, known as the Global South, according to Trust Economics, potentially creating a new trade order dominated by Chinese companies.

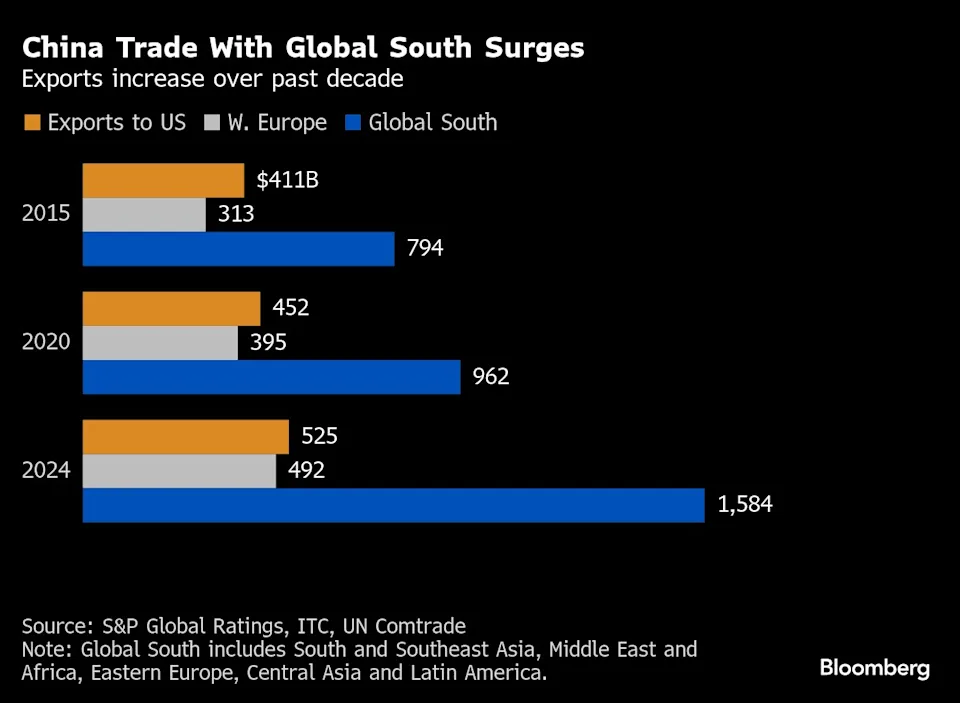

China’s exports of goods have doubled over the past decade to countries mainly in Southeast Asia, Latin America and the Middle East, compared with a 28% increase to the United States and a 58% increase to Western Europe. This trend has accelerated in the five years since Trump took office.

The push for changes to the trade map due to tariffs comes at a time when Chinese companies are looking for new markets abroad as the world’s second-largest economy shows signs of slowing and its companies are trying to build production bases for a range of products – from electric vehicles to electronics.

Chinese companies will continue to look for outlets in the Global South due to US tariffs and the uncertainty surrounding US policy, Trust Economics said. This trend will lead to trade within the Global South becoming the new center of gravity, and Chinese multinationals will emerge as new key players in these markets.

Last week’s economic data highlighted the blow from US tariffs on the Chinese economy, with industrial activity growing at its slowest pace since November and investment in real estate and infrastructure falling.

New trade deals and lifting barriers

Exports to the United States fell in July for a fourth straight month, data showed on August 7, although exports to countries in Africa and Southeast Asia more than made up for the decline.

Chinese officials have increasingly sought to strengthen ties with developing countries in recent months, lowering trade barriers and signing new trade agreements. In June, President Xi Jinping said he would eliminate all import tariffs on almost all African countries, and he has attended summits and held meetings with leaders in Latin America and Southeast Asia.

China’s trade with its 20 largest partners in the Global South now accounts for an average of 20% of their GDP, according to S&P Global. Moreover, more than half of China’s total trade surplus comes from the Global South, compared with 36% from the US and 23% from Western Europe.

The backlash

There has been some backlash, however, which Chinese officials will have to manage, as workers and industry associations protest cheap Chinese imports that are disrupting domestic industry.

What are the signals from the markets – When Chinese households buy stocks?

The Shanghai Composite Index (SCI) closed on Monday, August 18, at a decade-high of 3,728. This is not just a local event, but a global signal.

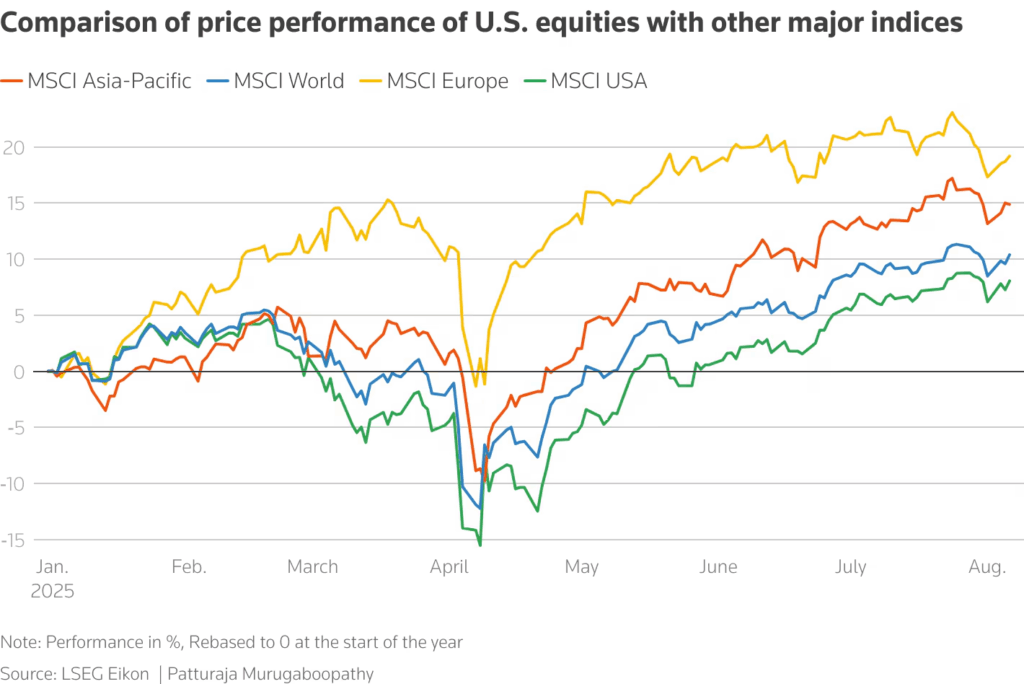

Markets are often shaped by perception: and right now the perception is that Asia is showing leadership at a time when many expected only caution. The 20% rise in the SCI since April is remarkable by any measure. It shows that confidence can return quickly when conditions change.

Chinese households, with near-record savings, are pouring cash into stocks. The immediate trigger was President Donald Trump’s decision to freeze the escalation of tariffs with Beijing, removing an immediate risk that had weighed heavily on sentiment. For months, international investors had been expecting a conflict.

The absence of new tariffs under the 90-day truce has unleashed pent-up demand. What is striking is the speed of the reversal. In April, Chinese stocks were selling off en masse, and international investors were reducing their exposure. However, by August, the market had rocketed to a decade-high.

Rising liquidity in markets and declining political risk

This kind of reversal shows the power of liquidity when combined with even a modest decline in political risk. The rise is not happening in isolation. Across Asia, momentum is building.

Indian stocks posted their biggest gain in more than three months on promises of tax cuts. The MSCI Asia Pacific index rose 0.4%, adding to signs that investors in the region are willing to take on more risk.

The timing is important: Asia is betting on growth, while European and US markets remain cautious, as Trump attempts a new mediation in the war in Ukraine. The Shanghai landmark has global significance because of those driving it.

Local retail investors are leading. With ample liquidity, they are fueling the rally at a time when international institutional investors remain largely hesitant. This divergence matters. It shows that regional funds are increasingly able to move markets on their own terms. The world can no longer take for granted that Wall Street sets the tone everywhere.

For investors outside China, Trust Economics figures that two lessons stand out:

- Capital flows are no longer tied to a single center of gravity. The US still has enormous influence, but regional markets are proving they can write their own narrative.

- Politics have an immediate and powerful impact. The Trump-Beijing trade truce is one of the clearest examples this year of optimism returning almost instantaneously when barriers and uncertainty are lifted.

The ripples are already visible

- Cyclical stocks across Asia are attracting more interest.

- Oil prices are stabilizing, with Brent trading around $81 a barrel as concerns about supply disruptions ease.

- Gold rose 0.4% as U.S. Treasuries rose, but safe-haven flows look vulnerable if investors continue to turn to stocks.

That’s why Shanghai’s rise should be seen as a harbinger, not a domestic quirk.

Local investors are showing what happens when liquidity meets confidence: markets react quickly and decisively. If sentiment in Europe and the U.S. follows suit, we could see a broad-based rally in global stocks in the final quarter of the year.

Timing is critical. If Trump’s mediation talks on the Ukraine war yield even a modicum of progress, it will add to the optimism already visible in Asia. Combined with a pause in the escalation of the tariff war with China, this could create the right environment for global capital to return to equities.

The Fed and Capital Flows

Later this week, the Federal Reserve’s annual meeting in Jackson Hole will give investors a new focus. Jerome Powell is widely expected to pave the way for a September rate cut after the recent weaker jobs data.

This tilts policy toward risk, but liquidity support matters little if investors remain paralyzed by geopolitical fears. Shanghai’s experience shows that when those fears subside, capital moves quickly.

From Trust Economics’ perspective, two broad conclusions emerge:

1. Asia is undervalued. The notion that it is simply following Western sentiment is challenged by a surge of this magnitude in the SCI, fueled largely from within.

2. The feedback loop between politics and markets is more direct than ever.

Every summit, truce or concession is priced in almost instantaneously. This volatility carries risk, but it is also the source of the greatest opportunities.

The decade-high in Shanghai is not just a domestic event. It is a global signal that liquidity, confidence and geopolitics are combining to reshape capital flows. International investors are watching closely, and many will be forced to reassess their positions. Asia is no longer simply reflecting the sentiment of global markets. It is increasingly setting the pace.