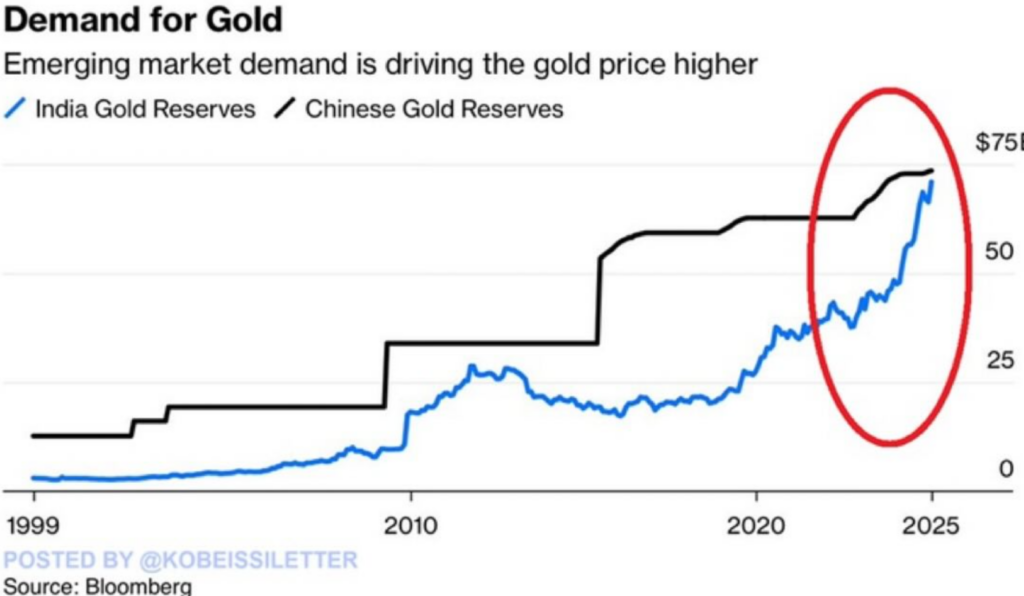

This eventually led to a major policy shift in central banks around the world. They began to favor gold over dollar- and euro-based assets.

Gold is apolitical — meaning it is not controlled by any government at will — and if stored properly, it cannot be arbitrarily seized. According to analysts, this was a primary factor in the yellow fever investment boom of the past 2+ years, which has had a significant impact on the international monetary system.

And even if President Donald Trump makes a deal with Vladimir Putin and returns the assets, who’s to say that a future U.S. president wouldn’t abuse his power?

As much as we want to believe that America will never have another president like Joe Biden, we have to admit that it’s a possibility. The Biden administration’s seizure of Russia’s central bank assets has changed the game for the foreseeable future.

Gold is much more attractive than it used to be, while fiat currencies are less so. That doesn’t look likely to change even if the war in Ukraine ends tomorrow. Gold has returned as a reserve asset, and its importance is only expected to increase in the coming decades.

Physical Gold Deliveries and China’s Role

When you look at the gold futures market as a whole, there are hundreds of ounces of “paper” metal traded for every ounce of actual physical bullion in a vault. Most of the time, the physical metal never changes hands or is ever delivered.

“Paper” gold and silver are simply traded on the market and then settled in cash. However, recently that has begun to change. A few weeks ago, news broke about the Bank of England vaults, where gold withdrawals are supported.

An unusual number of investors were requesting physical delivery. Deliveries that normally take a few days have taken up to 8 weeks. Apparently the Bank of England’s gold stock has… lightened somewhat, for now. But there is still plenty of unusual activity.

In London, this activity has reduced liquidity in the OTC (Over-the-Counter Market), which is overseen by the LBMA, and has sparked a race among London gold market participants to borrow gold from central banks, which store their reserves in the Bank of England vaults.

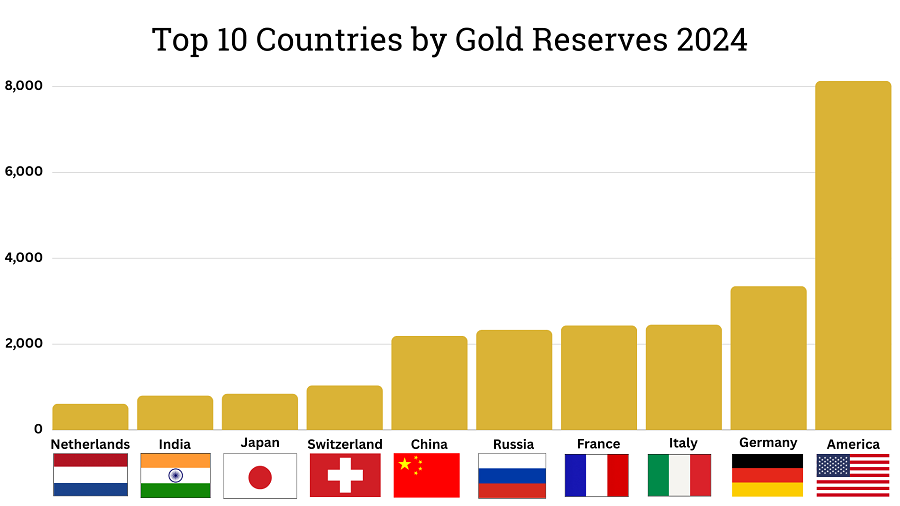

The main difference today is China’s activity. Over the past few decades, China has secretly bought thousands of tons of gold. Officially, the country only holds about 2,200 tons. However, some analysts believe that the Chinese may actually hold as much as 20,000 tons of gold (more than double the US reserves).

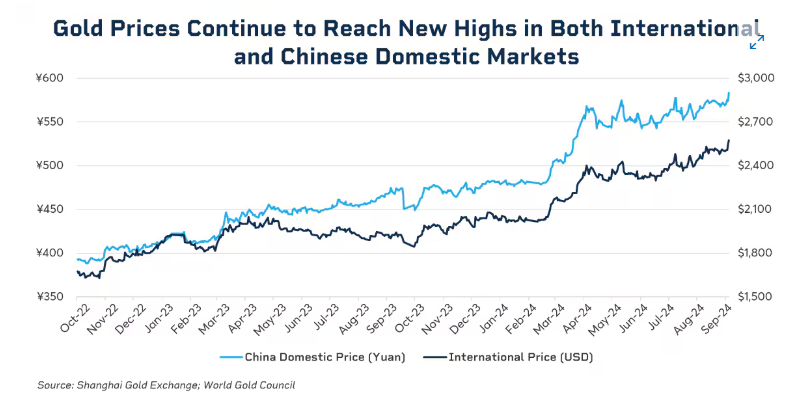

Today there are major gold exchanges in China, mainly in Shanghai, which compete with the LBMA and COMEX markets. The Chinese markets are basically driving the price higher today. The chart below, from the CME market, shows how prices rose first in China, followed by New York and London.

This eventually led to a major policy shift in central banks around the world. They began to favor gold over dollar- and euro-based assets.

Gold is apolitical — meaning it is not controlled by any government at will — and if stored properly, it cannot be arbitrarily seized. According to analysts, this was a primary factor in the yellow fever investment boom of the past 2+ years, which has had a significant impact on the international monetary system.

And even if President Donald Trump makes a deal with Vladimir Putin and returns the assets, who’s to say that a future U.S. president wouldn’t abuse his power?

As much as we want to believe that America will never have another president like Joe Biden, we have to admit that it’s a possibility. The Biden administration’s seizure of Russia’s central bank assets has changed the game for the foreseeable future.

Gold is much more attractive than it used to be, while fiat currencies are less so. That doesn’t look likely to change even if the war in Ukraine ends tomorrow. Gold has returned as a reserve asset, and its importance is only expected to increase in the coming decades.

Physical Gold Deliveries and China’s Role

When you look at the gold futures market as a whole, there are hundreds of ounces of “paper” metal traded for every ounce of actual physical bullion in a vault. Most of the time, the physical metal never changes hands or is ever delivered.

“Paper” gold and silver are simply traded on the market and then settled in cash. However, recently that has begun to change. A few weeks ago, news broke about the Bank of England vaults, where gold withdrawals are supported.

An unusual number of investors were requesting physical delivery. Deliveries that normally take a few days have taken up to 8 weeks. Apparently the Bank of England’s gold stock has… lightened somewhat, for now. But there is still plenty of unusual activity.

In London, this activity has reduced liquidity in the OTC (Over-the-Counter Market), which is overseen by the LBMA, and has sparked a race among London gold market participants to borrow gold from central banks, which store their reserves in the Bank of England vaults.

The main difference today is China’s activity. Over the past few decades, China has secretly bought thousands of tons of gold. Officially, the country only holds about 2,200 tons. However, some analysts believe that the Chinese may actually hold as much as 20,000 tons of gold (more than double the US reserves).

Today there are major gold exchanges in China, mainly in Shanghai, which compete with the LBMA and COMEX markets. The Chinese markets are basically driving the price higher today. The chart below, from the CME market, shows how prices rose first in China, followed by New York and London.

Physical and Monetary Gold – The Limits of Demand

The “Shanghai Gold Premium” is a relatively new phenomenon. The bigger story, however, is “unfolding beneath the surface.”

The real issue is the growing “disconnection between paper gold and physical supply. There is growing concern that the LBMA market and the Bank of England may not have enough gold to meet demand, leading investors to rush to physically own gold. Most gold futures contracts are usually settled in cash at expiration, but in January, there was an unusual surge in contracts opting for physical delivery.

Although the LBMA reported that gold shipments to the U.S. slowed in February compared to January. Arbitrage traders (the investor always has two opposing positions, where one hedges the other in order to eliminate investment risk) have also capitalized on the price gap between Western exchanges, such as the LBMA and Comex, and China’s Shanghai Gold Exchange International (SGEI), which continues to pay a premium for physical delivery and is “settled primarily in physical gold” rather than cash. This suggests that “confidence in ‘paper’ gold is eroding and investors are taking action to reduce the associated risk by securing physical possession.”

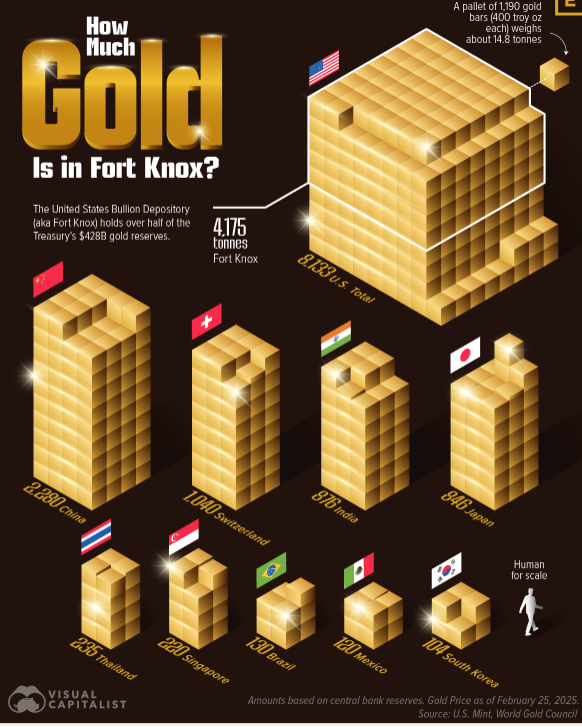

Fort Knox Inspection

In this context, US President Donald Trump promised to visit Fort Knox “to make sure the gold is there,” a question also raised by Elon Musk. Officially, the United States Gold Depository (commonly known as Fort Knox) holds more than half of the Treasury Department’s $428 billion gold reserves.

In this chart, we put that amount into perspective by comparing Fort Knox’s reserves to central bank gold reserves worldwide.

Physical and Monetary Gold – The Limits of Demand

The “Shanghai Gold Premium” is a relatively new phenomenon. The bigger story, however, is “unfolding beneath the surface.”

The real issue is the growing “disconnection between paper gold and physical supply. There is growing concern that the LBMA market and the Bank of England may not have enough gold to meet demand, leading investors to rush to physically own gold. Most gold futures contracts are usually settled in cash at expiration, but in January, there was an unusual surge in contracts opting for physical delivery.

Although the LBMA reported that gold shipments to the U.S. slowed in February compared to January. Arbitrage traders (the investor always has two opposing positions, where one hedges the other in order to eliminate investment risk) have also capitalized on the price gap between Western exchanges, such as the LBMA and Comex, and China’s Shanghai Gold Exchange International (SGEI), which continues to pay a premium for physical delivery and is “settled primarily in physical gold” rather than cash. This suggests that “confidence in ‘paper’ gold is eroding and investors are taking action to reduce the associated risk by securing physical possession.”

Fort Knox Inspection

In this context, US President Donald Trump promised to visit Fort Knox “to make sure the gold is there,” a question also raised by Elon Musk. Officially, the United States Gold Depository (commonly known as Fort Knox) holds more than half of the Treasury Department’s $428 billion gold reserves.

In this chart, we put that amount into perspective by comparing Fort Knox’s reserves to central bank gold reserves worldwide.

The data comes from the U.S. Mint and the World Gold Council. For illustrative purposes, we looked at a pallet of 1,190 gold bars (400 troy ounces each) weighing approximately 14.8 tons.

The data comes from the U.S. Mint and the World Gold Council. For illustrative purposes, we looked at a pallet of 1,190 gold bars (400 troy ounces each) weighing approximately 14.8 tons.

What is Fort Knox?

Located in Kentucky, Fort Knox is a U.S. military facility that serves as the primary storage facility for America’s gold reserves. The facility was established in the 1930s to protect the gold from potential foreign attacks.

The first shipment of gold arrived in 1937 via U.S. mail from the Philadelphia Mint and the New York Assay Office. During World War II, Fort Knox housed important U.S. documents, including the Declaration of Independence, the Constitution, and the Bill of Rights.

It has also housed international treasures, including the Magna Carta and the crown, sword, scepter, orb, and cape of St. Stephen, King of Hungary, before they were returned in 1978.

What is Fort Knox?

Located in Kentucky, Fort Knox is a U.S. military facility that serves as the primary storage facility for America’s gold reserves. The facility was established in the 1930s to protect the gold from potential foreign attacks.

The first shipment of gold arrived in 1937 via U.S. mail from the Philadelphia Mint and the New York Assay Office. During World War II, Fort Knox housed important U.S. documents, including the Declaration of Independence, the Constitution, and the Bill of Rights.

It has also housed international treasures, including the Magna Carta and the crown, sword, scepter, orb, and cape of St. Stephen, King of Hungary, before they were returned in 1978.

Please follow and like us: