It’s time to talk about gold as an investment. The precious metal has been in the headlines recently as its price has skyrocketed from $2,300 per ounce to around $3,500 per ounce. The chart is quite impressive, as the price of gold has been rising almost every month for over a year.

“So what?” many investors would reply. “A rise from $2,300 to $3,200 means that gold has only gained ~40% in a year and a half, while many tech stocks can rise that much in a few months!” However, according to Trust Economics, this way of thinking is common. Gold is not held in high regard in the investment world.

Warren Buffett once said that gold does nothing “but stare at you.” Buffett meant that as an investment, gold had little value because it does not generate cash flow or pay dividends. Both of these statements are true. However:

- Gold does not fail quarterly forecasts or collapse by 30% in a week (Meta, Target, and many other companies valued at over $100 billion have done so).

- Gold doesn’t “manipulate the books” and defraud its investors (Enron, Worldcom, Lehman Brothers, etc.).

- Gold doesn’t announce stupid mergers that offer little or no real value (eBay buying Skype, AOL and Time Warner, Yahoo and Geocities).

- Gold doesn’t go out of business or go bankrupt (Lehman Brothers, AIG, Borders, Blockbuster, etc.).

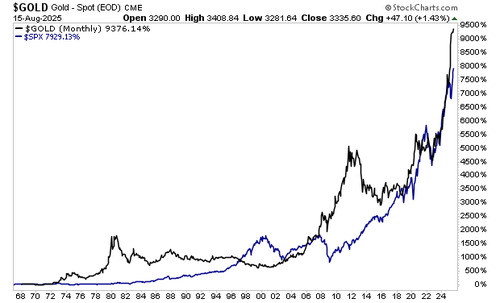

- Gold has actually been one of the best investments of the last 60 years. It has even CRUSHED stocks. And that’s not a typo.

- Gold, since mid-1967, has outperformed the S&P 500 and the Dow Jones Industrial Average by a wide margin. During that time, gold has risen more than 8,300%, while the S&P 500 has risen 6,600%.

Why was 1967 chosen as the starting date for this comparison?

Because gold was pegged to world currencies until mid-1967, when France became the first member of Bretton Woods to fully end the gold standard. Other countries followed suit, with the United States officially abandoning its own gold peg in August 1971.

Simply put, until mid-1967, gold was not a freely tradable asset class like stocks. Therefore, comparing its performance as an investment to that of stocks before 1967 is simply poor analysis.

Once gold was no longer pegged to currencies, and became a truly freely tradable investment, it crushed stocks for decades. Indeed, from 1967 to the present, the only times stocks have outperformed gold were during the tech bubble and the pandemic bubble: the most blatant stock market bubbles of the last 100 years.

Simply put, as an asset class, gold has proven to be one of the best investments in history. It’s true that some stocks have outright outperformed gold. But stocks as a whole have lagged gold.

Why is this happening?

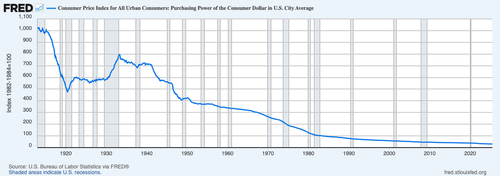

The chart below. Gold may not pay dividends or generate cash flow, but it retains purchasing power. And if there’s one thing the Fed has done well since it was given control of the U.S. dollar in 1913, it’s devalue the currency.

Simply put, there is always a reason to buy gold. Unless the Fed finally comes to its senses about the dollar and stops undervaluing the currency, gold will perform well in the long run.

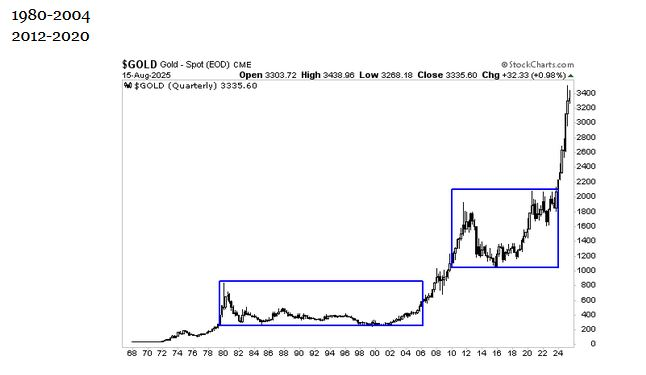

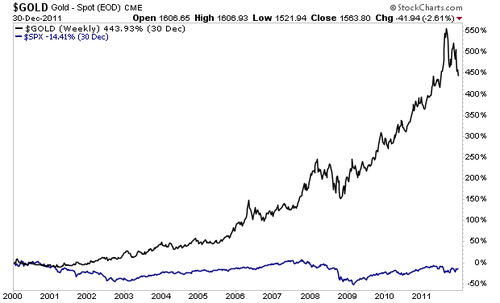

Note that the analysis is done in terms of decades here, not months or years. There are periods when gold does not move at all in nominal terms for years. The chart below illustrates some of these time periods.

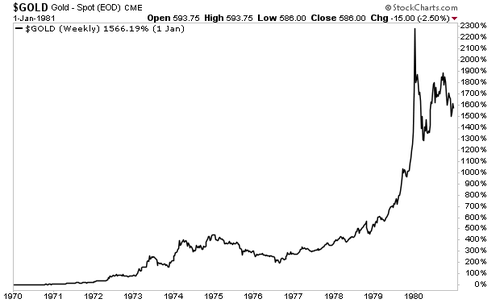

However, gold fully makes up for these periods when it goes up, as it typically runs hundreds of percentage points in a few years. During the bull market of the 1970s, gold ran up nearly 400% before spending the better part of four years stagnating. It then surged higher by 1,400% in a few years, for a total bull market gain of nearly 2,000%.

The bull market of the 2000s was much shorter, with gold only gaining 500%. However, it is worth noting that this was a period of deflation, not inflation. Furthermore, gold crushed stocks (blue line) during this period.

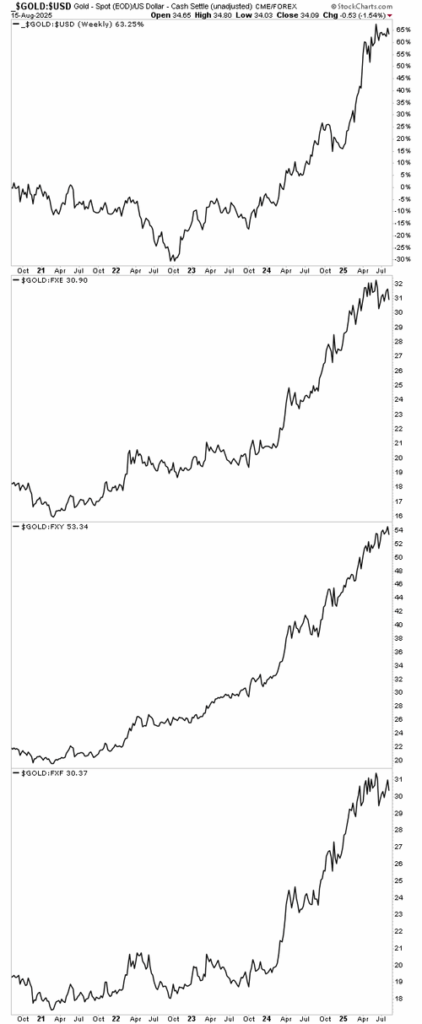

And we come to today… Gold recently signaled a tectonic shift, outperforming every major currency.

This is an important “signal” from the financial system. It’s one thing for gold to outperform the dollar, but seeing it outperform the euro, the yen, even the Swiss franc, is of systemic importance.

What does this mean?

Gold has learned that there is no path forward for policymakers that does not involve currency devaluation.

The world is awash in debt. In the US alone, there is over

- $14 trillion in corporate debt,

- $20 trillion in household debt, and

- $37 trillion in government debt.

Now, there are three ways to deal with excessive debt.

- Payoff/growth.

- Bankruptcy/restructuring.

- Inflation via currency devaluation.

Option 1 is not feasible for the US (or the rest of the world). There is simply too much debt.

Option 2 would trigger a crisis that would make the 2008 crisis look like a picnic.

Then there’s option 3.

Which do you think central banks and governments will choose? They’ll choose option #3: eliminate it through inflation.

This is what gold predicts: that there is no path forward in terms of macroeconomic policy that doesn’t involve more stimulus/money printing.

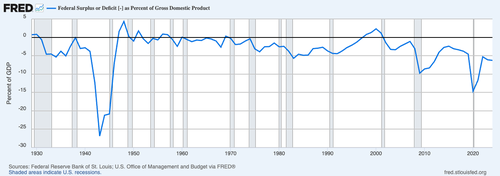

Take the US, where the Trump administration has abandoned all pretense of austerity, courtesy of the Department of Government Efficiency (DOGE). The deficit is 6% of GDP. To put that into perspective, it exceeds the deficit the US has had during every major recession in the last 100 years, except for the Great Financial Crisis of 2008! And this is happening while the economy is still growing!

What will happen when the US economy finally slows down… a deficit of 8%, 10% or 12% of GDP?

That would mean the US would be $40 trillion or even $45 trillion in debt within a few years! The impact on the dollar would be huge.

While the analysis focuses on the US, the same issues are prevalent in every major economy: China, Japan, Europe, the UK, etc. That’s why gold is outperforming every major currency.

That’s why gold is very likely to follow in a new long-term bull market. And that’s why smart investors are buying gold, expecting more depreciation in the currency once policymakers turn on the money printing presses again. Gold is signaling that a tectonic shift is underway in the financial system.

Trust Economics is urging investors to increase their exposure to gold and cryptocurrencies, predicting that the next big monetary policy measure will be Yield Curve Control. The pressure on the dollar’s value is intensifying as, so far in 2025, 88 interest rate cuts have been recorded by central banks worldwide – the fastest easing cycle since the COVID crash of 2020.

The Devaluation Scenario

The massive shift by central banks towards monetary easing, combined with new discussions about the Fed’s independence, a possible revision of the inflation target, price controls in key sectors, and even a revaluation of the value of gold, are creating the conditions for a new regime: “Disruption = Debasement”, that is, political deregulation leads to currency devaluation.

The likely outcome?

The dollar (DXY) could fall below 90, boosting the appeal of gold, cryptocurrencies and emerging markets in the second half of the 2020s.

Geopolitical upheavals and energy

Trust Economics is looking at geopolitical developments, urging investors to sell the Alaska oil “correction.”

Oil and gas prices have fallen 41% since March, pricing in a peace scenario between Russia and Ukraine.

However, if a potential US-Russian rapprochement in the Arctic region goes ahead, aiming to exploit the Northern Sea Route and the vast undiscovered energy reserves (15% of the world’s oil and 30% of its natural gas), price pressures will intensify by 2026.

But if the so-called US “deep state” prevents peace, all scenarios are nullified.

“Bubble” or new reality?

Trust Economics notes that the S&P 500 now has the highest price-to-book value (P/B) ratio in history – at 5.3 times, surpassing even the levels of the dot-com bubble.

This “bubble,” as reported by Trust Economics, is due to:

- Mass aversion to bonds

- Explosion of artificial intelligence

- Monetary devaluation

- New demographic patterns (Millennials/Gen Z investing in stocks instead of real estate)

- Shift of consumption from the US to the rest of the world

However, if it is not different this time, then bonds may return, and international stocks may surpass the S&P 500.

As investors await Fed Chairman Jerome Powell to send a message of further easing at Jackson Hole, markets are at historic highs: stocks, corporate bonds, gold and crypto.

The reasoning is that markets have already priced in interest rate cuts to offset labor market weakness and service the U.S.’s massive public debt.

To stabilize the U.S. Treasury’s annual interest payments, the 5-year bond yield would need to fall below 3.1%.