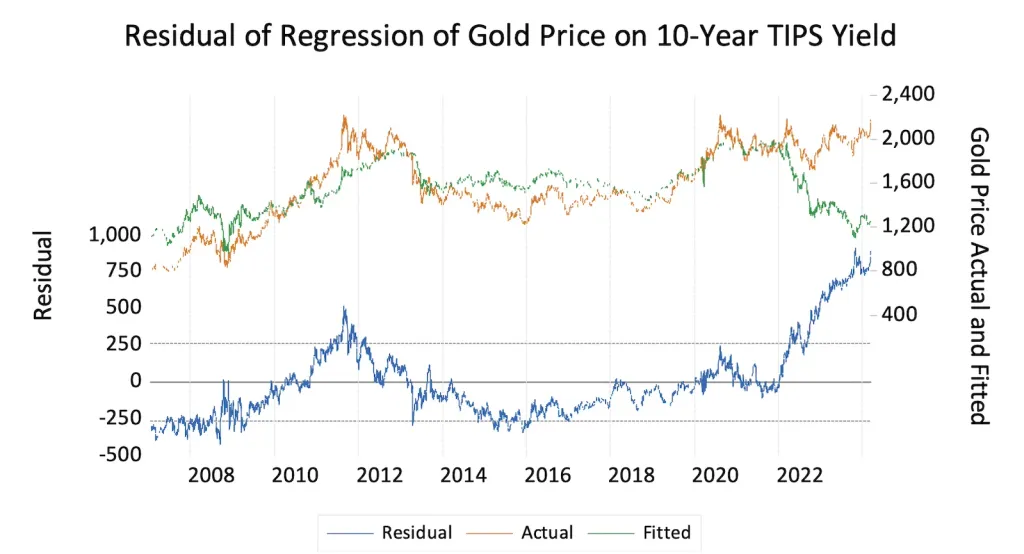

Investors, watching dark clouds loom over the global economy due to ongoing geopolitical upheavals, are hedging: Gold continued to break record prices on Friday, March 8, trading at $2,183 an ounce, and this was accompanied by from a more dramatic Bitcoin rally. Gold outperformed Bitcoin in 2020 and 2021, during the Covid crisis. This time Bitcoin clearly outperformed gold, suggesting that investors have more confidence in this form of crypto-value. The key to understanding how gold is a sensitive proxy for geopolitical risk is the long-term price relationship between US Inflation-Protected Securities (TIPS) and the precious metal. Both are hedges against an unexpected rise in inflation or a devaluation of the dollar. From 2007 to 2022, the price of gold moved steadily relative to TIPS yields, as investors used them interchangeably between the two assets. The illegal seizure of more than $300 billion in Russian reserves after Moscow’s February 2022 invasion of Ukraine changed that. Foreign central banks hold $3.4 trillion in debt, and all foreigners hold more than $8 trillion. The seizure of reserves convinced many foreign investors, both official and private, to turn to gold.

The options

This is why the value of gold predicted by TIPS yields remained very close to the actual price of gold from 2007 to 2022 and then became disconnected. Gold is now nearly $900 better in yield than TIPS.

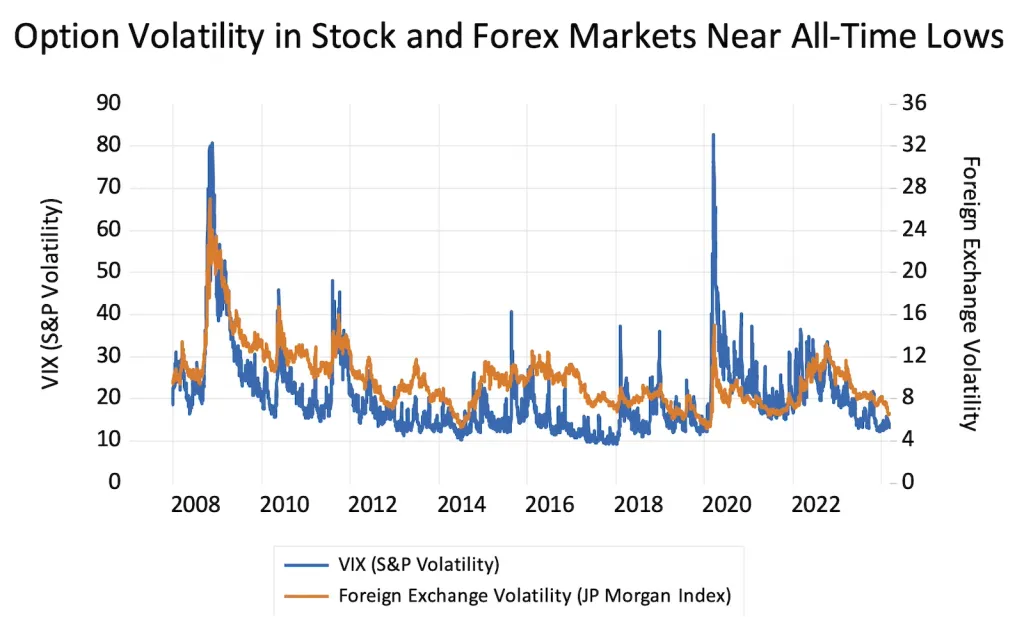

The spread between TIPS yields and gold was at an all-time high. This is all the more remarkable given the strong performance of global stock markets in recent months and the subdued pricing of hedging securities in options markets.

The cost of options on the S&P 500 (the VIX index) or the cost of options on major currencies is near an all-time low. However, options only provide hedges against short-term fluctuations and their payoff depends on the smooth functioning of the derivatives markets.

Investors obviously want to insure themselves against extreme events – the kind of problem that can arise from a geopolitical crisis – although they are not willing to pay much to hedge against short-term fluctuations. Despite the calm appearance of the markets, the possibility of a “black swan” event is increasing.

The fall of the dollar

The latest development pushing the US dollar further lower is the latest warning issued by Bank of America. The US economy is on the brink of collapse as debt service obligations rise at a record pace.

The U.S. national debt is now growing by $1 trillion every 100 days from 2023. If they come up with plans for big tax cuts or other major fiscal spending, markets could revolt, interest rates could just soar so high that can’t be serviced and we’d have a massive debt crisis in 2025. This horror scenario could very well happen. This could trigger an economic crash, sending the dollar crashing.