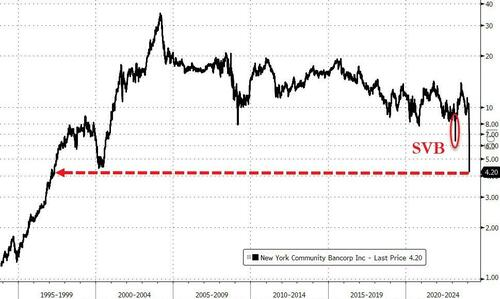

Opinions are being strengthened that maintained that the banking crisis in the US may not be over and that there is a risk of a new Lehman Brothers-style shock due to the purchase of commercial real estate. In this context, the share of the American bank New York Community Bancorp (NYCB), which is at its lowest levels since 1997, is in a permanent free fall.

A fuse of negative developments was the financial institution’s report of huge losses in the fourth quarter of 2023 and a reduction in dividend to shareholders from 17 cents to 5 cents. At the same time, the rating agency Moody’s revised its rating in hand, downgrading it to the “junk” category (Ba2 from Baa3). After the downgrade, NYCB widened its losses.

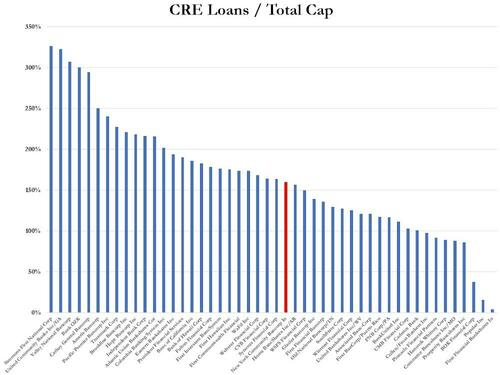

Thus, and while the American authorities tried to convince that the NYCB issue was idiosyncratic, Moody’s warns that the problem is general and that the Commercial Real Estate market carries a systemic risk. NYCB is known to have exposure to commercial real estate, a market that has historically performed well for it.

However, this cycle may be different due to higher interest rates and higher maintenance costs due to inflationary pressures. Beyond CRE, the bank has significant exposure to low fixed rate mortgages. This type of loan portfolio faces refinancing risk.

Tragic irony; Last year, NYCB bailed out the near-bankrupt Signature Bank. It is noted that once the commercial real estate market in the US was worth 3 trillion dollars, now it barely reaches 1.8 trillion dollars, which means that it has recorded losses of 1.2 trillion dollars to date.

In addition, Moody’s warns that this whole situation could end badly: “Increased use of market funding may limit the bank’s financial flexibility in the current environment.” The house also points out that, as of December 31, 33% of NYCB’s deposits were uninsured and “could face significant funding and liquidity pressure if there is a loss of depositor confidence.”

The total amount of outstanding government bonds and loans affected by this downgrade is $1.14 billion.

In addition, the bank said that deposits increased in 2023 to $83 billion and that total liquidity in the company exceeds uninsured deposits ($37.3 billion versus $22.9 billion of uninsured deposits). The bank also named board member Alessandro (Sandro) DiNello as executive chairman to “work with” CEO Cangemi. All this drags the share price down quite a bit from the lows (at $3.5).

Domino

Meanwhile, the severe recession in the US commercial real estate sector has already driven some banks in New York and Japan into a state of collapse due to their high exposure to commercial real estate (CRE). So this turmoil is now beginning to affect European banks as well. German banks were hit this week.

Deutsche Pfandbriefbank AG has high exposure to the US CRE market. The bank’s 150 million euro ($161 million) Tier 2 bond was priced 17.4 cents lower at 52 cents to the euro on Tuesday, Feb. 6 – by far the biggest intra-session decline. A smaller additional €300 million bond fell 9.5 cents – an even sharper drop after the loss the bank posted in the wake of Credit Suisse’s AT1 write-off last year.

Apart from Pfandbriefbank, the biggest losers on Bloomberg’s euro-denominated bank bond index were Landesbank Baden-Wuerttemberg’s €750m AT1 and Aareal Bank AG’s €300m bond. Pfandbriefbank shares have fallen about 15% this month.

There is a risk that PBB will have to increase provisioning for bad debts and thus put pressure on its already subdued profitability. But the turmoil is about profitability, not solvency, because of the bank’s capital reserves. Therefore, we should be more cautious in banks with larger exposures in these areas.

The German banking authority, BaFin, has advised that it is closely monitoring German banks and the CRE market. Just last week Aozora Bank, Japan’s 16th largest by market value, saw shares tumble after it slashed the value of some of its US CRE loans by more than 50%.