The US banking system is at risk of collapse, according to the indications we have based on the movements of the federal authority, the Federal Reserve, in order to force US banks to use the so-called discount window on their funds in order to prepare for future banking crises – which are certain to occur.

The ancillary credit facility is a form of liquidity provision by the central bank intended to help commercial banks manage their short-term needs. Banks that cannot resort to raising liquidity through the interbank market are able to borrow directly through the subprime credit facility process, paying the federal discount rate.

The goal is to remove the stigma surrounding the use of this bail out, which is part of the ongoing fallout from the failures of several major regional banks last year. Bailout describes how companies (or states, banks) are rescued through external recapitalization by taxpayers. It usually takes place in banks that are at risk of failure and threaten to inevitably damage the financial system as a whole (the famous systemic banks). Bail-in is another form of rescue which is carried out through financing by the banks’ shareholders and creditors themselves, rather than by taxpayers.

In banks, this is usually done by converting the bank’s bonds and shares into equity, the Federal Reserve, while economic leaders insist on the narrative of a “strong” economy because of the election cycle. Last Thursday, February 1, 2024, federal regulators are preparing a new framework or “haircut” of deposits.

As in the crisis of 2008

This new policy is reminiscent of the FED’s actions during the 2008 financial crisis, where financial authorities encouraged large banks to tap into the ancillary credit facility, borrowing directly from the Federal Reserve, in order to make it easier for troubled banks to follow suit. same road The reluctance of financial institutions to tap into this source of liquidity is justified. If the public believes that a bank needs support from the FED, it makes sense that depositors will leave the bank.

The express purpose of the FED is to provide cover from distressed banks, trying to prevent bank failures that are an inherent risk in today’s fragmented banking system.

Many Silicon Valley Banks

By forcing healthy banks to comply with a form of permanent bail out, the Fed escalates moral hazard in the financial system and leaves customers more vulnerable. They are certainly trying to deal with a risk of systemic collapse.

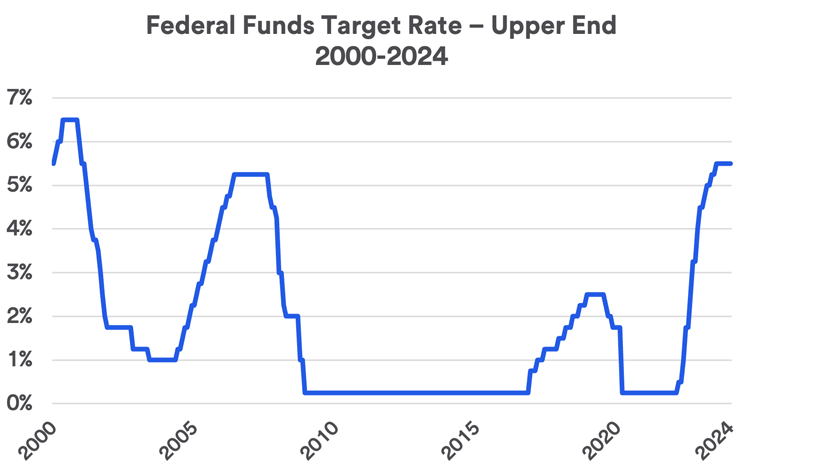

The regulator’s concerns about bank volatility are justified. The Fed’s low interest rate environment meant that financial institutions looking for low-risk assets bought US Treasuries at very low yields. As inflationary pressures drove interest rates higher, the market value of these bonds declined in favor of new, higher-yielding bonds. It was this pressure that triggered the collapse of Silicon Valley Bank last year.

The commercial real estate market

In addition, the state of the commercial real estate market creates greater risk for regional banks, which are exposed to 80% of these mortgages.

In the previous low interest rate environment, investors viewed commercial real estate as “a haven for investors who need reliable returns.” Unfortunately, the same period saw significant changes in consumer behavior. Online shopping, telecommuting and the amount of vacant commercial real estate increased at the expense of traditional investments.

Lockdowns have only further reinforced these trends. As a result, commercial real estate debt is considered one of the riskiest financial assets in existence today, these “toxic” assets are sitting on the balance sheets of regional banks across the country.

The collapses of regional banks

These pressures have had a significant impact not only on this recent policy of federal regulators but also on the logic of their response to the failures of the past year. After the collapse of the SVB, the FED created the Funding Program, which allowed banks and credit unions to borrow using government bonds and other assets as collateral.

This emergency measure reflected fears that other banks were also at risk of collapse. The Fed has signaled its willingness to let that program expire in March, with the goal of banks expanding their use of the ancillary credit facility.

The election cycle – The story for the masses

At a time when the actions of the FED and financial regulators show real concerns about the health of US banks, these same institutions have predicted an upward trajectory for the state of the economy and that is the narrative they are telling the public.

Fed Chairman Jerome Powell and Treasury Secretary Janet Yellen have consistently described the US economy as “robust” in recent months, a view not shared by the majority of Americans, according to economic policy approval polls. Additionally, Powell declared victory on inflation last December, even as the indicators the Fed uses to track inflationary pressures remain well above the 2% target.

In stark contrast to previous statements about the need to aggressively tackle inflation as it risks becoming endemic to the economy. The direction of monetary policy obviously cannot be divorced from rosy statements by government officials about the economy, especially in a presidential election year.

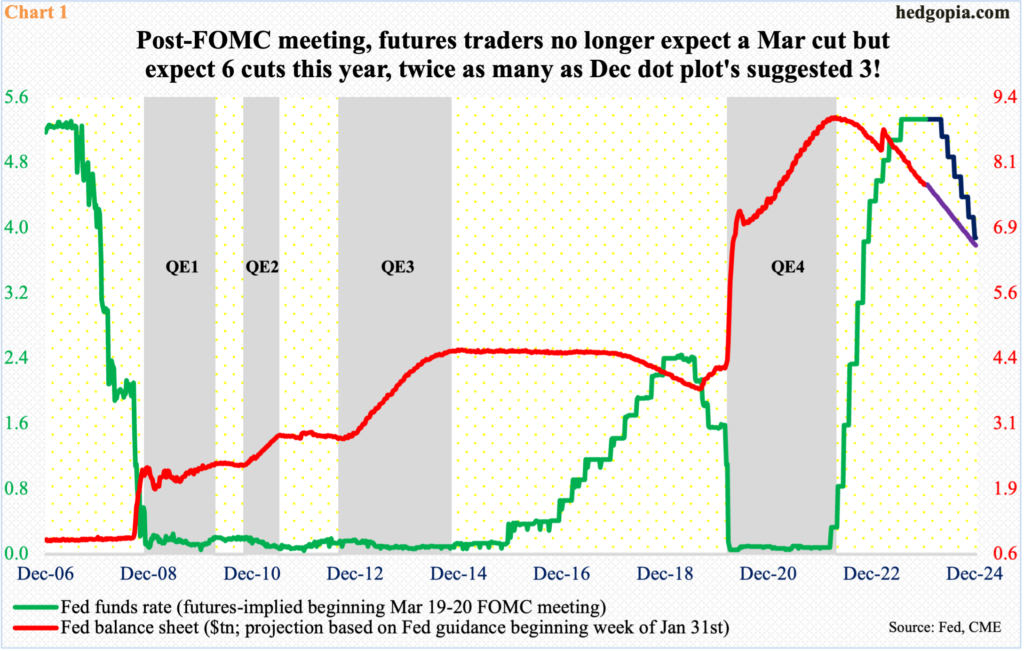

Another motivation for projecting economic strength, however, is the retooling of the Federal Reserve’s monetary policy “army.” While Fed officials’ projections of rate cuts in 2024 reflect the narrative of the growing strength of the US economy, the reality is that this choice stems from the needs of dire economic realities.

The FED has proven time and time again that if given the choice between forcing Americans to suffer the consequences of inflation or bailing out the financial system, it will choose the latter.

With the 2024 election in full swing, Americans will be constantly bombarded with political lies and empty promises, not just from politicians, but from government agencies and the central bank. We can wait another ten months to tell us how strong the economy is, but the actions taking place behind the scenes tell a very different story