The economy is built entirely on trust and confidence, and has rarely looked as vulnerable as it does today. Even the usually calm Bank of England and the International Monetary Fund are now warning of the possibility of a sharp, destabilizing correction in stock markets, which have been overblown by excitement about the transformative potential of artificial intelligence.

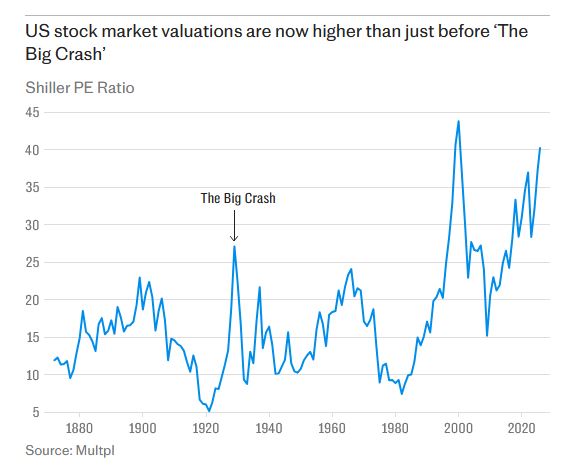

Valuations have reached their limits, with the so-called “Shiller Cyclically Adjusted Price Earnings Ratio” – generally considered the most reliable indicator of where the market is relative to previous highs – approaching the all-time high set during the dot.com bubble and slightly higher than it was before the Great Crash of 1929.

The parallels with previous stock market manias are striking. US stock valuations are now higher than before the “Great Depression”.

Uncertainty

There are many things out there on the planet that create an atmosphere of uncertainty, geopolitical instability, intolerable government spending, and the resurgence of militarization.

Over-enthusiasm

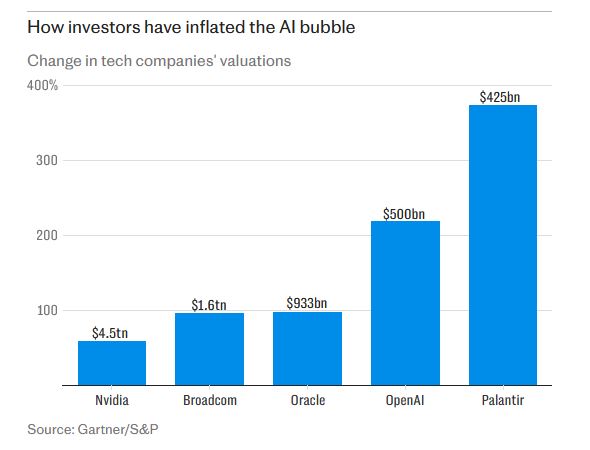

While it is unclear what event will burst the bubble, there is no doubt about the bubble itself. The buzz around AI is out of control, with the grand prize being the dominance not of the generic AI chatbots we are used to using in our daily lives, but of so-called “artificial general intelligence,” or computers with cognitive abilities similar to those of a human, only infinitely faster and more powerful.

The dangers of the AI frenzy are not limited to rampant stock market speculation. Such is the scale of investment and promise in AI that its failure could have potentially catastrophic consequences for the entire global economic system.

This is especially true for start-ups and large tech giants that have invested billions in developing applications that use AI. If the technology fails to live up to its promises, or if its actual performance proves to be far below expectations, financial markets could experience an explosive combination of stock price declines, employee layoffs, and business strategy revisions.

The bubble will burst, and the consequences will be visible everywhere. Even if AI does indeed prove capable of changing the nature of production and services, the benefits will not be immediate, and the problems of the social and economic distribution of production may grow rather than decrease.

Layoffs, inequalities and social unrest, as was the case with the first Industrial Revolution, could intensify, while the workforce itself would be in immediate danger.

Problems in the development of Artificial Intelligence

The problem with AI is that despite the fantastic possibilities that are projected, this technology is not ready for mass adoption. Many of the companies and products that are supposed to be based on artificial intelligence do not perform as expected.

Developing intelligent systems that understand and respond to the human mind remains extremely difficult, with many of the applications being imperfect and limited in their functionality.

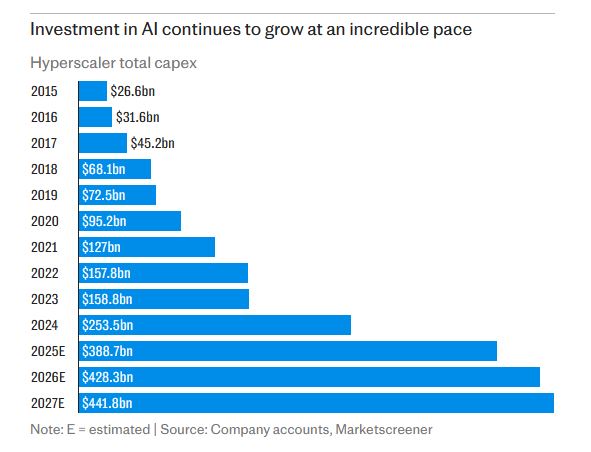

The result is that the “promise” of a radical transformation of the economy through AI is still hypothetical and out of the immediate horizon, even if investments continue to flow.

The excessive estimates of future profits, which led many companies to invest in non-existent or overpriced products, create a risk for the market and the workers who rely on these short-term successes.

The connection with past bubbles

The analogies with past bubbles are clear. As happened with the 2008 financial crisis, investors had exaggerated expectations of real estate prices, believing that prices would continue to rise. The fall in real estate prices was disastrous for the financial market, causing a global recession.

In the case of artificial intelligence, failure or overestimation of its true value could cause a similar “chain reaction”, destroying confidence and liquidity in the market.

Another similarity is the sharp increase in investment in a new and unexplored technology, without sufficient knowledge of its risks or real potential. In the history of stock market manias, the same thing happened with the “pharmaceutical companies” in the 1980s and the corporate bond “bubbles” that followed. In the end, the lack of real value and sustainability led to the collapse.

Assessing the Possible Developments

If history has taught us anything, it is that financial markets, when overheated by the “golden prospect” of a new technology, can create bubbles that eventually burst.

As speculation around AI grows, the pressure for a market correction intensifies.

However, the impact of this correction is likely to be much greater than past crises, as AI affects many aspects of our daily lives and the global economy.

The combination of conflicting geopolitical risks, economic imbalances, and the pressures from AI is leading us to a world that is highly volatile and difficult to predict. Whether the AI crisis comes sooner or later, the outcome could be cataclysmic.

As much as most central banks try to avert a major financial crisis, the warnings about market movements are becoming increasingly alarming. It is impossible to say for sure whether 2027 or 2028 will be the new turning point, but market dynamics point to a path toward an AI bubble and its collapse.

Politicians, governments and investors need to prepare for the next big disruption – whatever it may be.