The question is whether a central bank – systematically indulging in unprecedented purchases of gold – can have the same strategy in other precious metals. The Russian government is considering spending 51 billion rubles ($535.5 million) over the next three years to replenish its reserves of precious metals. The figures come from figures in the government’s Draft Federal Budget, published on September 30. While gold has been a major asset in foreign exchange reserves, the proposal shows the Russian government is seeking to expand its holdings to include silver metals and platinum. The formation of a reserve of refined precious metals as part of the State Fund of Russia will contribute to ensuring a balanced federal budget and stable economic growth, as well as meeting the industrial needs of the Russian Federation in case of emergency,” according to a note from the Russian Ministry of Finance. The draft budget did not include details of a possible shopping program. However, the inclusion of silver in foreign exchange reserves could generate new investment interest, restoring it as an official “monetary” metal. Central banks stopped hoarding silver in the mid-1850s, and the world moved off the silver standard in the early 1870s. Russia may be more interested in maintaining a strategic supply of the precious metal because of its industrial use. This year, there has been a strong push by producers to include silver on the US and Canadian governments’ critical metals lists.  Silver is a critical precious metal in the alternative energy sector. According to the Silver Institute, industrial silver consumption is expected to increase 9% to 710.9 million ounces this year. Russia’s decision to add silver to its reserves sets it apart from most other central banks, which have focused heavily on hoarding gold while neglecting silver. Along with several other bullish factors, Russia’s markets could be a key driver in pushing prices to $50 and above. The silver market is expected to experience its second-highest supply shortfall on record due to demand in the solar energy sector, with demand for silver for photovoltaic (PV) solar panels expected to rise 20% to 232 million ounces. While 60% of silver demand comes from industrial applications, investors should not completely dismiss silver’s role as a monetary asset. Russia will also know that silver is being manipulated through COMEX futures will put pressure on the market. Russia’s involvement in the palladium market is not surprising, as it is a major producer of the metal. Last year, Russia produced 28% of the world’s platinum. However, exports of palladium, platinum and rhodium have been significantly affected due to severe economic sanctions imposed by Western nations following its invasion of Ukraine in 2021. The market for domestically produced palladium will provide critical support for the mining industry. Russia had a stockpile but sold it in 2012. The new strategic reserves of precious metals align with Russia’s broader economic outlook. Last month, Russian President Vladimir Putin said Moscow should consider limiting exports of critical metals including uranium, titanium and nickel, further underscoring the country’s focus on controlling key resources.

Silver is a critical precious metal in the alternative energy sector. According to the Silver Institute, industrial silver consumption is expected to increase 9% to 710.9 million ounces this year. Russia’s decision to add silver to its reserves sets it apart from most other central banks, which have focused heavily on hoarding gold while neglecting silver. Along with several other bullish factors, Russia’s markets could be a key driver in pushing prices to $50 and above. The silver market is expected to experience its second-highest supply shortfall on record due to demand in the solar energy sector, with demand for silver for photovoltaic (PV) solar panels expected to rise 20% to 232 million ounces. While 60% of silver demand comes from industrial applications, investors should not completely dismiss silver’s role as a monetary asset. Russia will also know that silver is being manipulated through COMEX futures will put pressure on the market. Russia’s involvement in the palladium market is not surprising, as it is a major producer of the metal. Last year, Russia produced 28% of the world’s platinum. However, exports of palladium, platinum and rhodium have been significantly affected due to severe economic sanctions imposed by Western nations following its invasion of Ukraine in 2021. The market for domestically produced palladium will provide critical support for the mining industry. Russia had a stockpile but sold it in 2012. The new strategic reserves of precious metals align with Russia’s broader economic outlook. Last month, Russian President Vladimir Putin said Moscow should consider limiting exports of critical metals including uranium, titanium and nickel, further underscoring the country’s focus on controlling key resources.

Gold as an economic shield

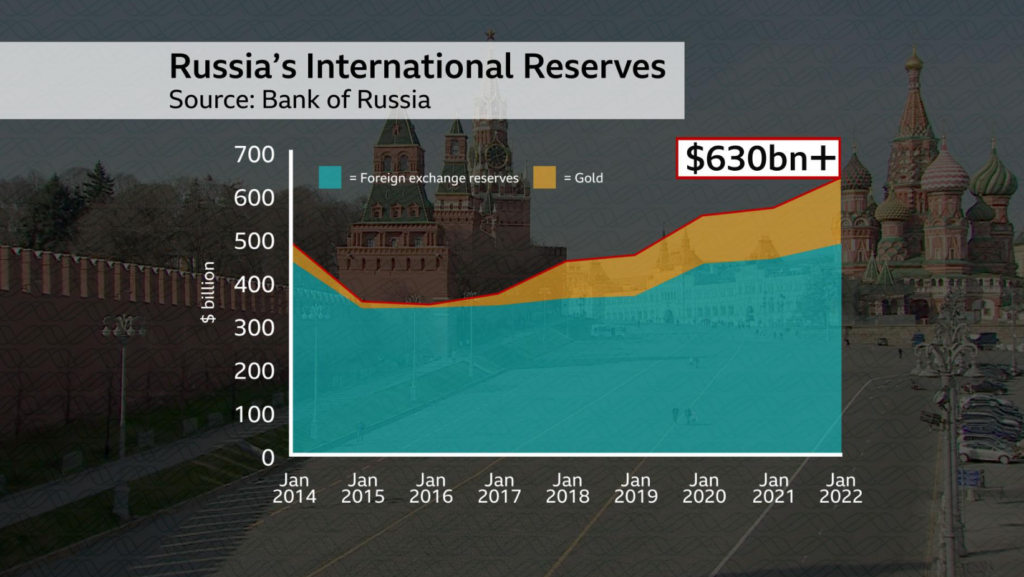

As of October 1, 2024, Russia’s monetary gold reserves increased by $10.95 billion, a staggering 5.8% increase to $199.764 billion, an unprecedented performance.

Gold now accounts for 31.5% of the country’s total reserves, marking a bold move in Russia’s economic strategy amid growing global uncertainties.

Russia’s aggressive hoarding of gold is more than just an economic maneuver—it’s a statement. In the face of Western sanctions, Russia has turned to gold as the ultimate safe haven. While much of its foreign exchange reserves remain under severe restrictions, Moscow’s gold reserves have remained untouched.

The Central Bank has used this valuable asset both as a shield against economic volatility and as a weapon in the wider geopolitical landscape. Russia’s strategic emphasis on gold also underscores its pursuit of independence from the dollar-dominated financial system.

As global power shifts continue, Russia is placing gold at the heart of its monetary future, bolstering investor confidence in its ability to weather storms — economic, political or diplomatic.