The global financial system is approaching an economic collapse, with the United States appearing more vulnerable than ever, Trust Economics reports in an analysis. The United States, with a public debt that has skyrocketed from $250 billion in 1971 to about $38 trillion today, is trapped in a vicious cycle of loss of confidence.

From political window dressing to the harsh reality of the numbers

Military and political operations are often presented as moves to “restore democracy” or “crush illegality.” In practice, however, the real reasons lie elsewhere: in oil, the dollar and US bonds. The hegemony of the United States after the war was based on two main pillars:

- In the dollar as the world reserve currency

- In the petrodollar, that is, in the agreement to price oil internationally in dollars.

This agreement, built in the 1970s after the abandonment of the gold standard, absorbed the overproduced dollars and created artificial demand for US bonds. But this system is now creaking dangerously.

Dedollarization and the flight to gold

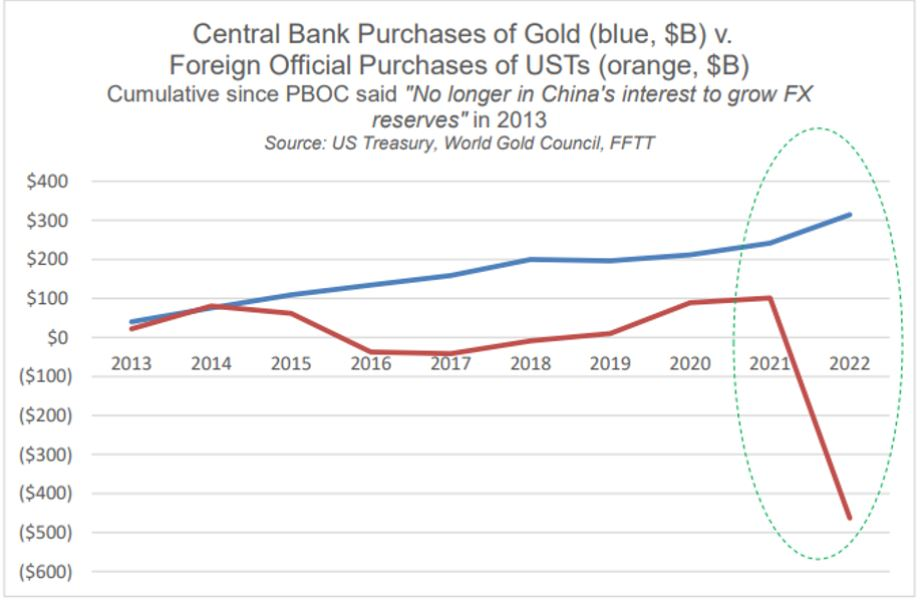

After 2022 and the use of the dollar as a geopolitical “weapon” through sanctions, confidence in the US currency has taken a critical hit. Central banks are systematically reducing US bonds and drastically increasing gold reserves.

This is a cold strategic choice. Gold has maintained its purchasing power, while the dollar has lost more than 99% of its value against the precious metal since 1971. Today, for the first time, central banks hold more gold than US bonds, a fact that is a resounding bell for Washington.

Why is Venezuela in the spotlight?

In this context, Venezuela is taking on a pivotal role. It has vast reserves of heavy oil, exactly the kind that American refineries need. At the same time, Caracas has strengthened its contacts with China and other powers that promote non-dollar transactions.

Trust Economics notes that the effort to remove Venezuela from China’s sphere of influence is not just geopolitical. It is a fight for survival for the dollar. If major oil-producing countries abandon the dollar, then:

- Demand for US bonds will collapse

- Yields will skyrocket

- Debt servicing costs will become unsustainable.

In this scenario, the Fed will be forced to print even more money, accelerating the path to a monetary and economic crash.

The Spectre of Crash and the Role of Gold

The picture described is not just alarming, but historically familiar. When confidence in the currency collapses, so does the system that supports it. And then, as history shows, gold acts as a last resort.

In a world of rising geopolitical tension, dedollarization, energy conflicts, and uncontrollable debt, the prospect of a major economic crash is not an exaggeration, but a realistic scenario.

As Trust Economics concludes, Venezuela is not the cause of the crisis; it is the symptom. The real problem lies at the heart of a system built on debt, cheap money, and military rule. And that system now appears to be reaching its limits.

Please follow and like us: