The impasse in the world’s largest economy is obvious and worsening, especially with public debt reaching the $28 trillion zone. The only solution on the horizon to maintain creditworthiness is monetary expansion (in technical terms: debt monetization).

In order to understand these unusual developments, we need to see what the Federal Reserve’s scope for action is in providing liquidity to the economy and what “printing dollars” means in practice. It will create hyperinflation and address the real causes of fiscal mismanagement.

John Williams, president of the Federal Reserve Bank of New York, said on Friday, November 7, 2025, that the US central bank, which last week decided to stop reducing its bond portfolio, may soon need to start buying bonds again, thereby increasing the size of its balance sheet.

“The next step in our balance sheet strategy will be to assess when the level of reserves has reached the “ample” point, from the current state of “somewhat above ample,” Williams said in a speech at the European Central Bank Conference on Money Markets 2025 in Frankfurt. When that happens, he added, “it will be time to start the process of gradual asset purchases.” “Based on the recent sustained pressures in the repo market and other growing signs that reserves are moving from excess to adequate, I expect that we will soon reach the ample point in terms of reserves,” Williams added.

At the last meeting of the Fed Board, it was announced that as of December 1, the three-year process of shrinking the portfolio of bonds that the central bank had acquired as part of measures to support the economy and the financial system during the COVID-19 pandemic would end. Since 2020, the Fed has doubled the total size of its assets, reaching a peak of $9 trillion, through massive purchases of government bonds (Treasury) and mortgage bonds.

Since 2022, it has allowed a predetermined amount of securities to mature without renewal (to be rolled out), with the aim of maintaining sufficient liquidity in the financial system to have stable control over the range of the federal funds rate, its main tool for influencing the economy, while allowing moderate volatility in money market funds.

Recent signs of rising money market rates, combined with the Fed’s frequent use of its liquidity tools, have shown the bank that it has gone far enough in its process of reducing its portfolio, leading to the decision to keep its balance sheet steady at its current level of $6.6 trillion.

The Fed could resume bond purchases as early as the first quarter of 2026. Williams cautioned that it is difficult to estimate exactly when the Fed will reach the level of reserves that will require a new infusion of cash into the system. “I am closely monitoring a number of market indicators related to the fed funds market, the repos market and the payment systems to assess the state of reserve demand,” he said. However, he cautioned that bond purchases to manage liquidity are not a form of monetary policy stimulus.

“The purchases in the context of reserve management will be the natural next stage in implementing the Federal Open Market Committee’s (FOMC) “ample reserves” strategy and do not indicate any change in the basic direction of monetary policy,” Williams said. He added that the Fed’s interest rate control tools, such as the reverse repo facility and the Standing Repo Facility (mechanisms to ensure short-term liquidity in the banking system), are operating effectively, and he expects active use of the latter, which provides liquidity to eligible entities, in the near future.

The Growth of the Money Supply and the Role of the Federal Reserve

It is generally argued that referring to the Federal Reserve’s operations as “money printing” is not rhetoric, but reality. This position is based on a refutation of Ben Bernanke’s 2010 speech, in which he described how the Fed digitally increases bills. However, this view, while partly valid, overlooks how the system actually works.

To understand the growth of the money supply, it is essential to distinguish between the creation of reserves and the creation of deposits.

It is argued that referring to the Federal Reserve’s operations as “money printing” is not merely rhetorical, but structurally accurate. “Money printing” describes the Fed’s ability to create unlimited digital reserves to buy government debt, and it is argued that the Treasury’s operations affect leverage in the financial system.

The process essentially functions as money printing and should be treated as such, according to this view. While his view highlights the magnitude and potential consequences of monetary interventions, it misunderstands the process by which money is created in the modern banking system.

To clarify this, it is crucial to distinguish between the creation of reserves by the Federal Reserve and the creation of broader money (such as deposits) by commercial banks.

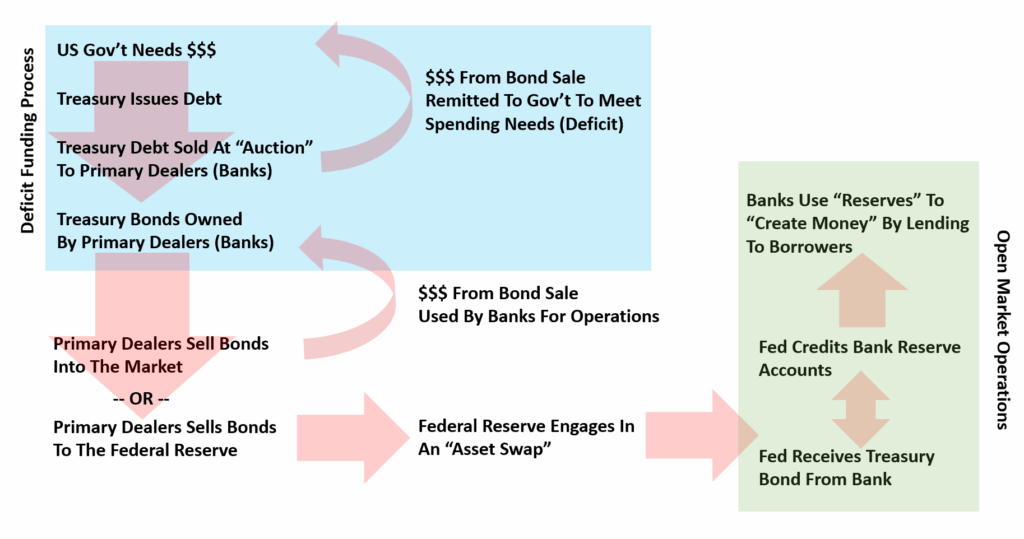

Reserve creation

The Federal Reserve creates reserves through open market operations (OMOs). It buys government securities or mortgage-backed securities from commercial banks. In return, it credits those banks’ reserve accounts.

These reserves are digital entries on the books, not physical money. The bank ends up with more reserves and fewer securities—but its total assets don’t increase. The money supply doesn’t increase at this stage.

The process in steps:

- The government issues debt to cover spending that exceeds revenue (i.e., the budget deficit).

- Primary dealers (specialized banks that act as special dealers) buy this debt by participating in auctions.

- They can then sell the bonds to other investors or to the Fed.

- If they sell them to the Fed, the Fed credits the bank’s reserve account.

- The bank now has more reserves, but no increase in its total assets.

- On the Fed’s balance sheet, assets increase as much as liabilities.

So, there is no “printing money” – only an asset swap.

Is creating reserves “money printing”?

The phrase “money printing” traditionally refers to the physical printing of money that goes directly into the economy. But today, most money is deposits in commercial banks, not paper money.

As the Bank of England explains: “When a bank makes a loan, it usually does not give out physical cash … but credits the borrower’s account with a deposit of equal value.” In other words, money is created through lending, not by the Fed. Commercial banks create money when they lend.

How is broader money (deposits) created?

When a commercial bank makes a loan:

- It creates an asset (the loan).

- It also creates a liability (the deposit in the customer’s account).

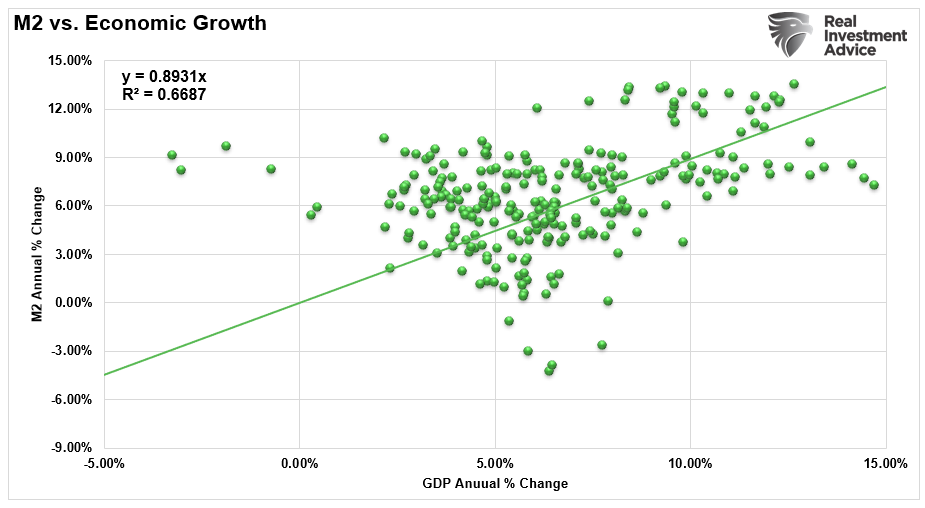

- This new deposit increases the money supply (the M1, M2, etc.)

- Banks do not “lend” reserves – they simply have to have enough to cover payments and regulatory capital adequacy requirements.

Will inflation skyrocket?

Between 2008 and 2020, the Fed massively increased reserves through quantitative easing (QE), but inflation remained low. Only when the government sent direct checks to households (i.e. actually spent in the real economy) did temporary inflationary pressure arise.

So, creating reserves is not the same as increasing the money supply in circulation. It is emphasized that modern money markets rely heavily on collateral, wholesale financing, repo markets, and shadow banking.

Indeed, as the Bank for International Settlements (BIS) recognizes, non-bank intermediaries now play a huge role in liquidity and credit expansion. However, these phenomena do not negate the basic function of the banking system: that money is created through lending.

As Andrew Bailey (Governor of the Bank of England) pointed out: “Commercial banks can create money simply by extending loans to their customers.”

- All money is lent into existence.

- The Fed’s reserves are not spent.

- The increase in the money supply comes from loans and fiscal spending, not from Fed purchases of securities.

- Asset swaps change the form of money, not its quantity.

Simply put, the Federal Reserve’s “money printing” is accounting, not physical; it changes the form of money, not its quantity — and it does not automatically mean inflation.

It remains to be seen whether Donald Trump, through the Federal Reserve and monetary policy, will address the fiscal diversion and inflationary pressures from tariffs – the raw material for a massive explosion is there…

Please follow and like us: