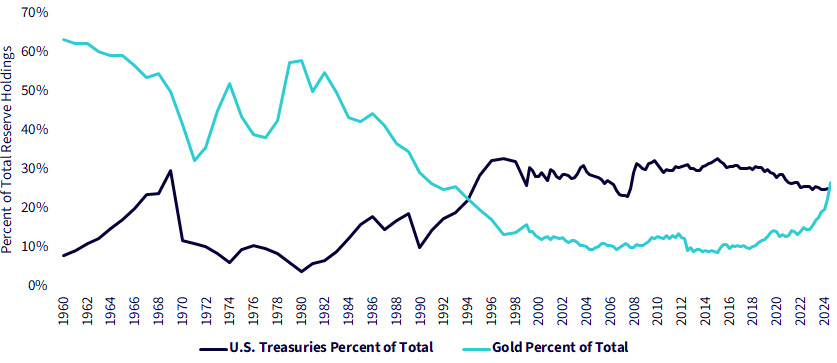

A historic gold buying spree by central banks is reshaping global foreign exchange reserves, signaling a broader shift away from the dollar amid growing geopolitical and economic uncertainty.

Silent inventory reallocation

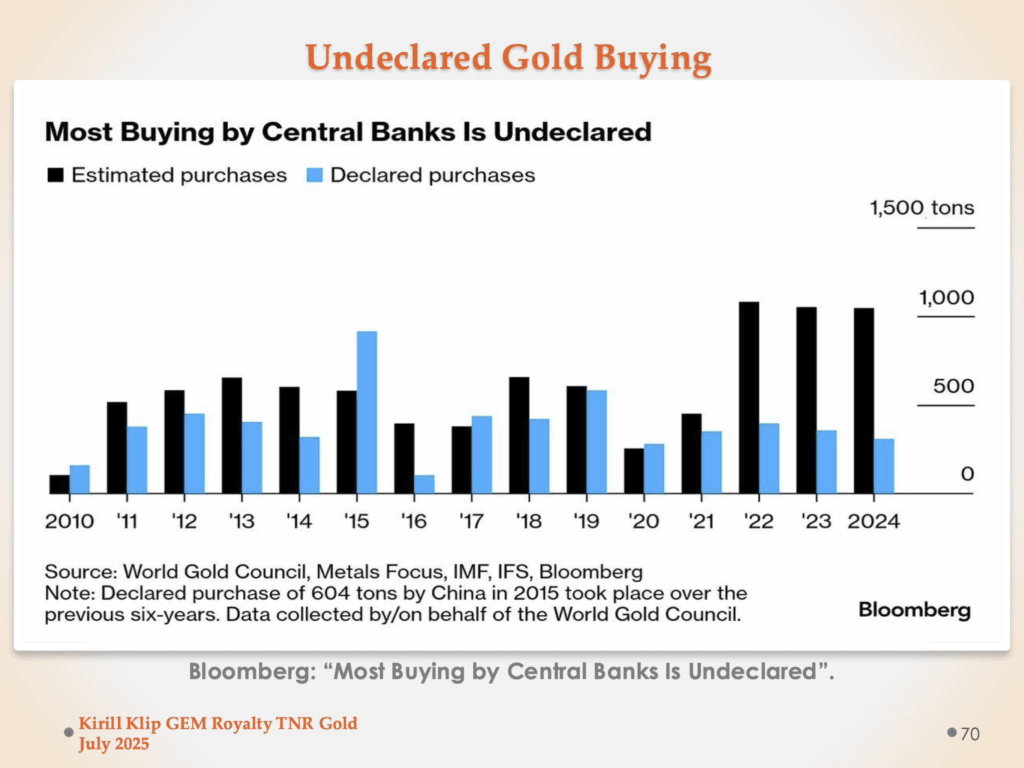

Central banks buy more than 1,000 metric tons of gold annually, with much of that buying unreported. Heightened fears of the dollar being weaponized, inflation and geopolitical tensions are driving a shift toward gold.

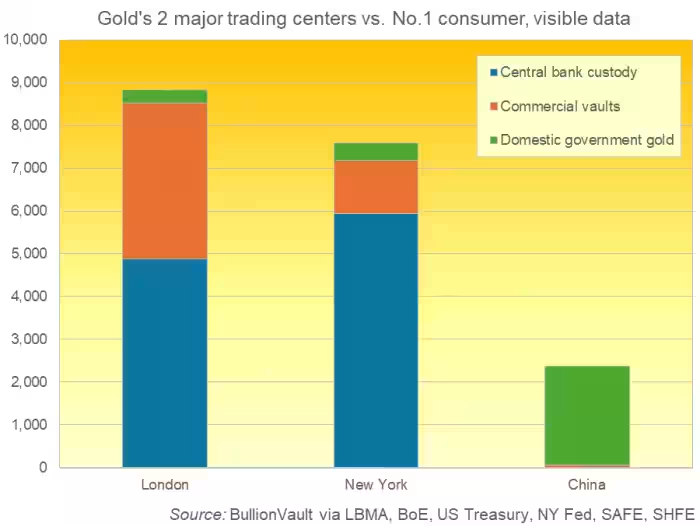

China’s secret purchases, which pass through multiple intermediaries, suggest its gold reserves are much larger than either the official statements or bankers’ official statements. Strategic demand for gold is expected to push prices to $3,700 by the end of the year and possibly $6,000 by 2029, according to leading market analysts.

What the data says in more detail

Central banks have shown a strong and sustained appetite for gold over the past three years, making 2022, 2023 and 2024 the three consecutive highest buying years since 1967.

This level of demand—double the average seen a decade earlier—is largely seen as a structural shift rather than a temporary cyclical behavior, suggesting a long-term realignment of global monetary reserves.

In the first half of 2024 alone, net global gold purchases reached 483 tonnes, up 5% from the same period in 2023, while the first quarter of 2025 also saw strong demand with 244 tonnes.

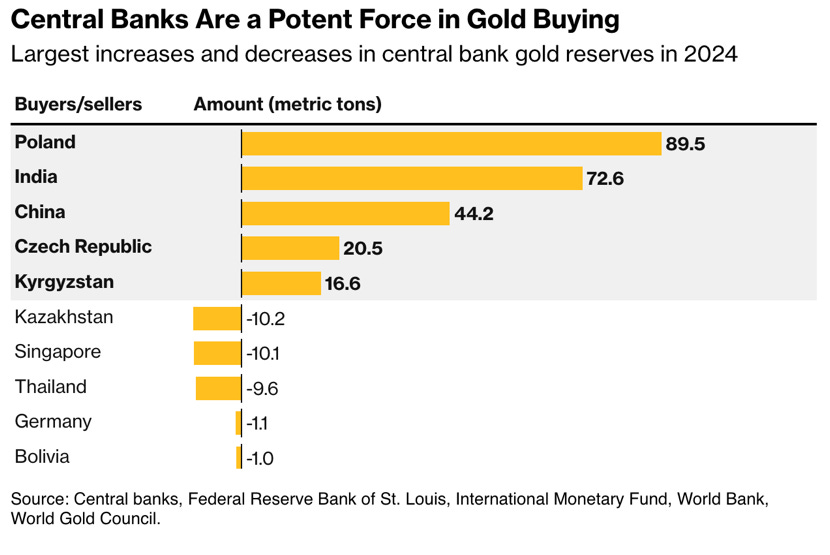

Emerging market central banks are leading this trend, accounting for around 69% of total gold purchases in 2023, with Asian and Middle Eastern banks being the most active.

Key players include:

- the People’s Bank of China (PBOC) (SSE: 601988), which added 225 tonnes in 2023 and continued its purchases in 2025•

- the National Bank of Poland, the largest buyer in 2024, with 90 tonnes, aiming for gold to account for 20–30% of its total reserves•

- the Reserve Bank of India (RBI), which has been continuously adding gold since 2017.

Other significant buyers include Turkey, Russia, Singapore, Uzbekistan and the Czech Republic. The motivations behind these significant purchases are multiple:

- diversification of reserves to reduce dependence on the US dollar,

- the adoption of gold as a safe haven in times of economic uncertainty and geopolitical tensions,

- hedging against inflation, to protect against the erosion of purchasing power,

- a strategic move for geopolitical “insurance” and monetary dominance, especially under the fear of sanctions or freezing of foreign exchange reserves.

The price explosion

This continued demand from central banks has been a major driver of the gold price, which has repeatedly reached historical highs.

International gold futures recently reached $3,744/ounce and closed at $3,705.80/ounce in September 2025.

Large purchases signal central banks’ confidence in the stability and intrinsic value of gold, while also strengthening sentiment in the broader market. Unlike speculative investors, central banks adopt a long-term strategy, creating persistent demand that provides steady support for prices.

A notable difference from previous decades is the absence of significant gold sales by central banks, which in the past have exerted constant downward pressure on prices.

With demand from central banks now accounting for approximately 25% of annual global gold demand, their movements have enormous weight in the market and contribute substantially to current historical gold valuations.

The Growing Allure of Neutrality

Amidst economic fragmentation and currency uncertainty, central banks are leading a quiet revolution in the management of foreign exchange reserves.

Gold—once considered an obsolete relic of an old financial world—is regaining its central role as a strategic asset.

Recent estimates show that central banks are accumulating nearly 80 metric tons of gold per month, an amount equal to about a quarter of global mining capacity.

What makes the trend even more striking is its opacity. A significant portion of this accumulation is not declared to international organizations. Trade data suggests that a large volume of gold is being channeled through Switzerland and the United Kingdom, two key refining and storage centers for the precious metal, before reaching its final destination. These “traces” point to official sector involvement, but the identities of the buyers remain unclear.

Outlook: A rally with deeper roots

The surge in demand reflects a broader shift in central bank priorities. The tying up of foreign exchange reserves in recent geopolitical conflicts has raised alarms about the credibility of the dollar as a neutral reserve asset. For many countries, gold now appears to be a safer haven—independent of political decisions, sanctions, or external scrutiny.

At the same time, high inflation, budget deficits, and interest rate divergences have bolstered its appeal. Unlike bonds, gold is not someone else’s liability (like any currency). Its ability to maintain its value in crises has made it both a “safe” and a strategic asset.

Data from 2024 show that only a third of gold purchases by official institutions were publicly reported. The rest was derived from trade balance differences, particularly in exports of 400-ounce bars (commonly used by central banks) from London to Asia. Even when market conditions made these transactions seemingly unprofitable, shipments continued—signaling that the motives were not commercial but monetary.

Return of economic power and dominance

With many emerging economies holding just 5–6% of their reserves in gold, there is room to increase towards the global average of around 20%.

A gradual adjustment towards this target could keep demand strong without shocking the market. At the same time, the limited rate of supply growth and “latent” demand provide structural support to prices. Trust Economics estimates that a modest reallocation of global foreign reserves into gold—just 0.5%—could push the price above $6,000/ounce in the coming years.

For now, the year-end price target of $3,700 reflects strong fundamentals. Gold’s comeback is not just about price—it’s about power, risk management, and economic dominance. In an era where financial alliances are increasingly taking on a political character, the “yellow” metal is becoming a neutral field for international monetary strategy.