If gold…were judged in an impartial monetary court, the jury would unhesitatingly declare that the precious metal is a superior form of money.

The proponents of fiat currency (paper money without any equivalent) would lose both the legal battle and the theoretical argument, while the defenders of “sound money” would present overwhelming evidence and irrefutable testimony.

A growing body of evidence, coming from central banks, national governments, and a global banking regulator, confirms a truth long known and indisputable.

The irrefutable evidence:

1. Central banks around the world officially hold about 38,000 metric tons of gold — a record by one estimate — an amount that corresponds to about 20% of all gold ever mined.

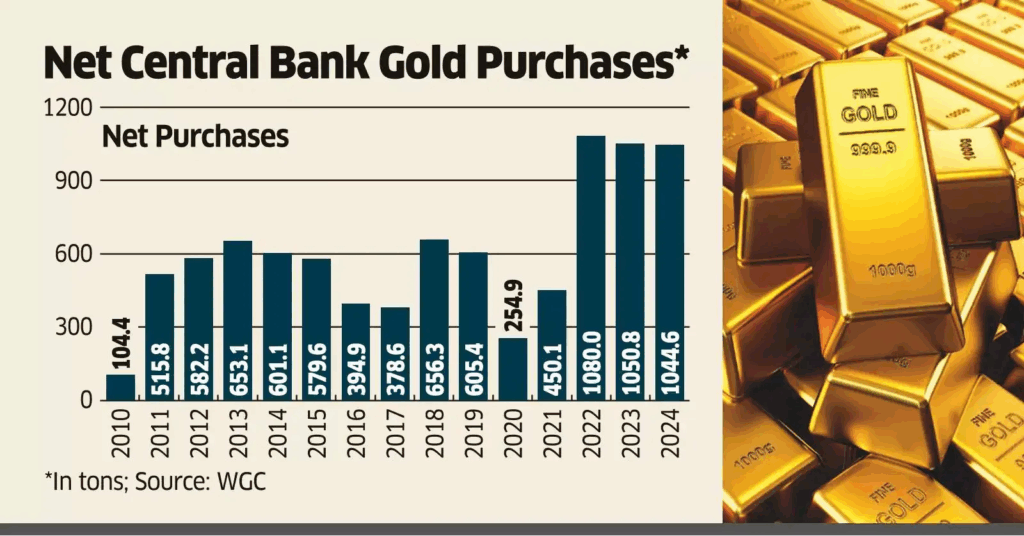

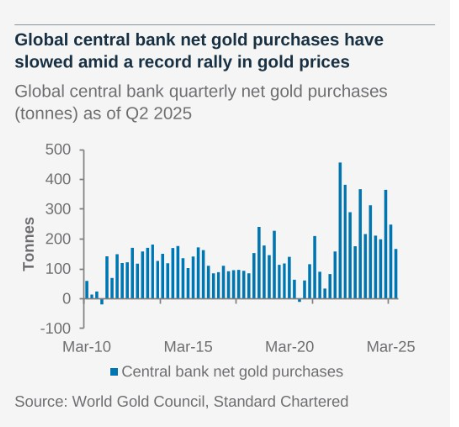

2. For 15 consecutive years, central banks have been net buyers of the yellow metal. The accumulation trend continues, with 378 tons of net purchases in the first half of 2025 alone.

3. Gold is acquired and held by central banks because it is money, as the American banker and investor J.P. Morgan had already confirmed a century ago: “Money is gold, and nothing else,” he declared in 1912 to a congressional inquiry into Wall Street’s money trusts.

4. The total gold reserves of central banks are likely to be higher than official figures, as some countries (e.g. China) are believed to be underreporting their holdings. Alternatively, they may be lower or misreported if Western countries have sold or leased some of their reserves in recent decades to push down the price of the metal.

5. Since 2012, central banks and national treasuries have repatriated between 1,200 and 1,500 tons of gold from foreign vaults, confirming the adage: “If you don’t own it, it doesn’t belong to you.”

6. Countries bring their gold “home” because domestic storage is considered safer than storing it abroad, especially when the metal can be sold, leased or exchanged for undervalued fiat currency.

7. The ongoing repatriations directly contradict former Fed Chairman Ben Bernanke’s 2011 statement that central banks hold gold only as a “long-term tradition,” not because it is money.

8. Despite their mistakes, central bankers are not naive. They would not buy, hoard, and repatriate tons of gold if it did not hold its value better than fiat money.

9. Stability is a fundamental characteristic of a sound and reliable currency. For banks and individuals, gold acts as a financial “safety net” when fiat currencies fail.

10. Gold is a high-quality, risk-free, liquid asset that is equivalent to cash when physically held in a bank vault, in accordance with Basel III regulations. In short, gold remains money, even though it has not been used as an international currency or medium of trade since the 1970s.

11. Basel III is a regulatory framework of the Basel Committee on Banking Supervision (BCBS), which sets global banking standards. It was designed to restore stability and transparency to banking policy after the 2008 crisis. The BCBS is affiliated with the Bank for International Settlements (BIS), known as “the central bank of central banks.”

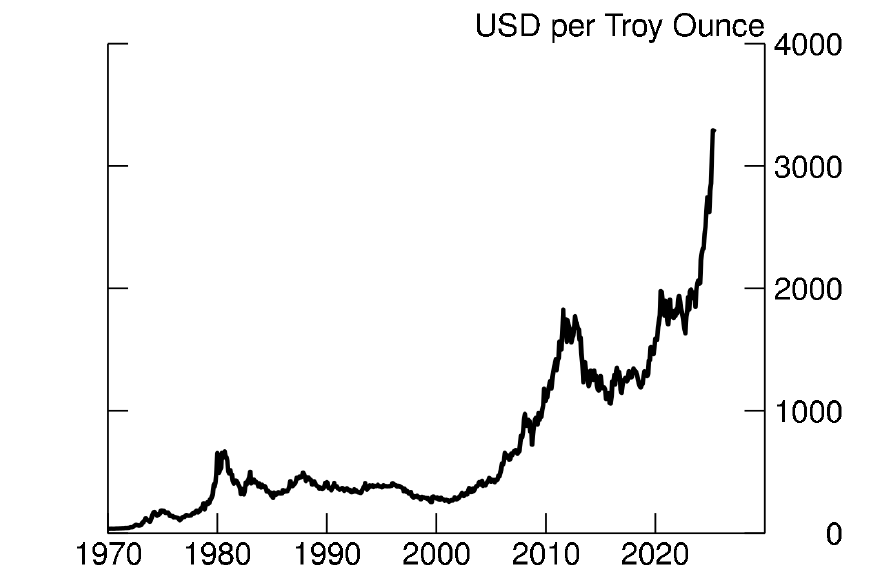

12. Gold allows governments to create liquidity, reduce debt, and avoid default. Monetary authorities periodically revalue its official value to boost liquidity and avoid default.

13. On August 1, a Fed economist published a study of five countries (Germany, Italy, Lebanon, Curaçao and Sint Maarten, and South Africa) that have revalued their gold over the past 30 years to pay down debt and improve their fiscal balance sheets.

The introduction to the study, Official Reserve Revaluations: The International Experience, states: “With public debt at high levels, some governments are considering ways to finance additional spending without raising taxes or adding to existing public debt. One possibility is to use the profits from a revaluation of gold reserves, as has been recently proposed in the US and Belgium.”

14. The Fed itself would not have approved such a study if gold revaluation were not a real option. The revaluation confirms that gold is money and that its official price has been kept artificially low by government mandate.

15. With its recent price rise to $3,400/ounce, gold is the second largest reserve asset of central banks after the dollar. Combined with continued strong demand, this phenomenon indicates that depreciating dollars, euros and other fiat currencies are being exchanged for appreciating gold.

A wise choice, given that gold has a natural and inverse correlation with depreciating digital and paper currencies.

The verdict: Gold is money — and the evidence proves it is sound and superior money.