How much do bond markets want to drive us crazy, while those who are not involved in the subject give investment advice? At a time when Hurricane Trump has caused international turmoil through retaliatory tariffs and an underground currency war regarding the dollar exchange rate, the once-maligned European South is on the first… shelf of investment options.

- Let’s deal with the case of Greece and look at the data quite superficially:

According to the final data of the Greek Ministry of Finance for the first half of the year, the Greek State Budget showed an improvement in the overall fiscal deficit, compared to the target for the same period. The target for this period predicted a deficit of 2.8 billion euros, while the actual figure also recorded a deficit of 0.56 billion euros, recording an improvement of 2.23 billion euros (-79.8%) compared to the State Budget target.

The primary fiscal balance, in the same period, was in surplus and exceeded the target by 2.28 billion euros (102.2%).

Following the first half of 2025, both the primary balance of the State Budget, as well as the corresponding total revenues, tax revenues including VAT revenues, and expenditures show the government’s commitment to fiscal discipline.

It is noted that 2024 was the third consecutive year after the pandemic period (2020-2021) and the seventh since 2014 (with the exception of 2015) that Greece achieved a significant primary surplus at the General Government level.

It is noted that in 2024 the overall fiscal balance of the General Government was positive at 1.3% of GDP and is expected to be positive for both 2025 and 2026 at 0.7% and 1.4% of GDP respectively, according to the European Commission’s Spring Forecasts.

The numbers are good, but what do they mean:

That the Greek government, in order to record a primary surplus – and prepare the famous “provider package” of approximately 2 billion to buy votes as it is collapsing – has “raised” all the money from the market in order to finance the “blue” party mechanism. The debts of state bodies to the Greek market reach 4 billion euros.

We have the unique phenomenon of fiscal discipline from which the market does not benefit in order to increase the produced economic product, employment and wages, but the… party-controlled state mechanism. More specifically,

- The concentration of NSRF resources in a series of “friendly entrepreneurs” with direct – the European Public Prosecutor’s Office is already dealing with the issue and news will come from September – has concentrated the flow of European funds by implementing a policy of creative destruction regarding over-indebted and over-taxed small and medium-sized enterprises, in accordance with the Pissarides report (which is often cited by Kyriakos Mitsotakis and the economic staff).

- Nominal Wage increases that lead to lower… real incomes due to inflation which reached 3.1% in July – the cartels are intensifying inflationary pressures.

- At the same time, public infrastructure and the field of public goods are deteriorating due to disinvestment – transportation (broken buses, accidents, metro decline), health services and the public education system, further lowering the standard of living of citizens, which instead of converging with Europe is slipping into a Balkan disintegration, depriving the new generations of prosperity.

Conclusion: The fundamentals of an economy must be viewed as a whole. Despite the positive sample of a household, the Greek economy does not show any growth prospects and is probably not a … tasty morsel for global investors, even if the bonds issued by the Greek government are guaranteed by the ESM (European Stability Mechanism).

What’s happening in the debt markets?

In a beautifully crafted presentation of the facts, a Bloomberg report presents the debt of the former PIGS as an opportunity for investors who… want to avoid the… rollercoaster of Trump’s economic policy that wants to turn the wheel of the world’s biggest… ship — and may drag the small boats along…

And all this perhaps to make some good commissions for some traders…

What the story is: Fifteen years ago, Guillermo Felices was helping his clients navigate the eurozone debt crisis. Now, he’s praising the bonds that were once at the center of that storm.

Italy, Spain, Ireland, Portugal and Greece, which in 2011 nearly collapsed under the weight of their debt, have since become top picks for firms like PGIM Fixed Income, where Felices works as a London-based investment strategist.

A shift in the hierarchy

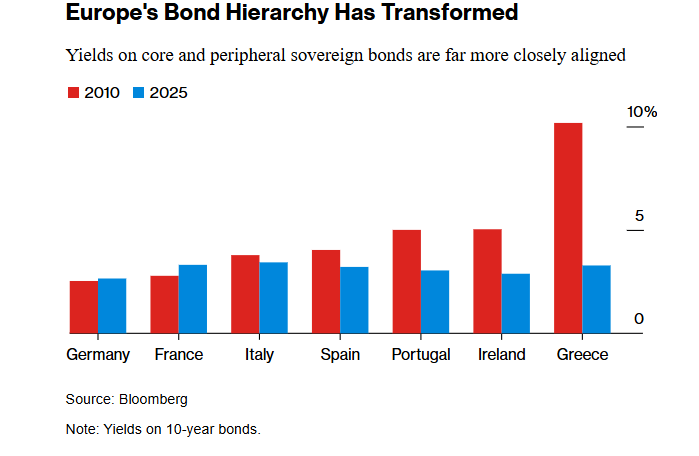

His recommendations reflect a major historical shift in the hierarchy of the region’s government bond market.

The recovery of the peripheral countries has been the result of years of struggle, and as investors turn away from President Donald Trump’s policymaking, their bonds are increasingly seen as sound alternatives to the debt of Europe’s largest economies.

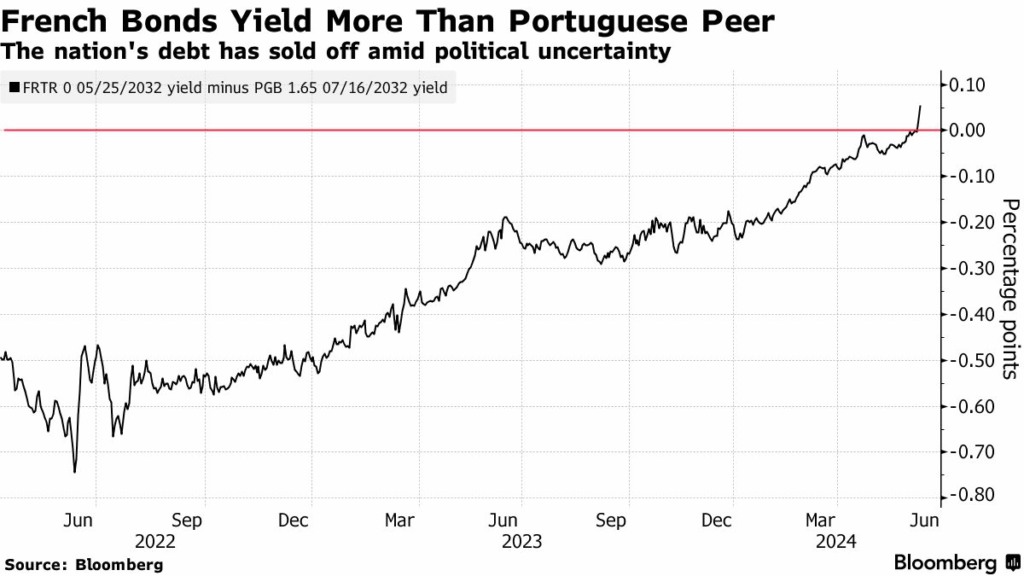

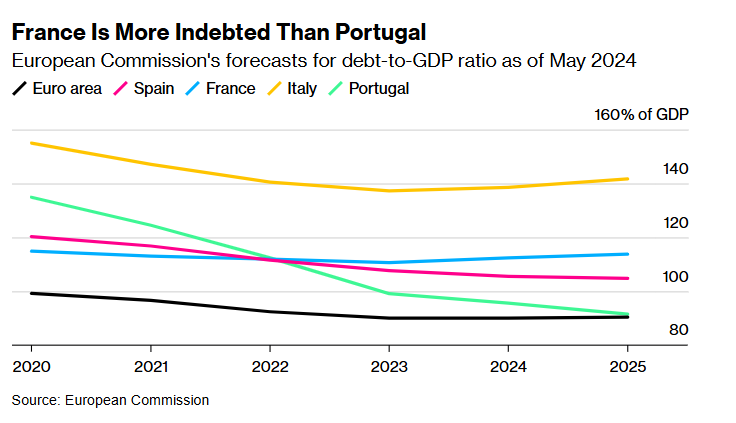

Spanish, Greek and Portuguese bonds now yield less than French ones.

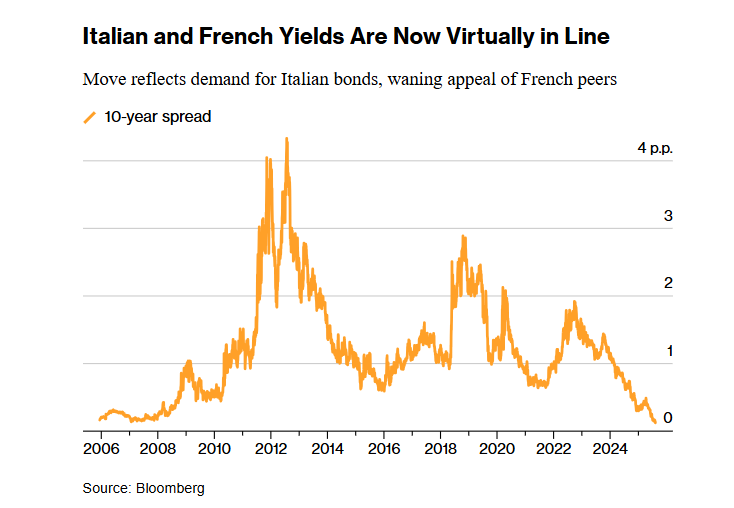

Italy is on track to outperform Germany and France for the fourth consecutive year in terms of overall performance — equaling the longest streak on record.

Central and regional government bond yields are now much closer together.

“After the crisis, the narrative was always that Europe would be difficult to break up,” Felices said, referring – how could it be otherwise – to a history of low growth, excessive public spending and disagreements between member states.

“That is less true now, especially in terms of fiscal excess, while the US has a more unorthodox image.”

US government bonds have come under pressure this year, particularly in April when Trump unveiled a package of aggressive trade tariffs. Concerns about the US fiscal outlook have also returned.

The appeal of regional bonds, meanwhile, is due to the post-pandemic economic recovery, which has outperformed the economic “powerhouses” of Germany and France.

Spain is supposedly a particular bright spot, expected to grow by about 2.5% this year, more than double the pace of the wider bloc.

Investor exposure to peripheral European countries remains near five-year highs, according to a monthly Bank of America survey published on Friday (8/8).

Germany’s dangerous turn…

Another major turning point came in March, when Germany abandoned decades of fiscal austerity and pledged to invest billions of euros in defense and infrastructure – breaking with the religiously pious fiscal policy.

While this is seen as a key catalyst for EU growth, the coming flood of German bonds has made some investors more cautious, pushing up German debt prices – a recipe for a new debt crisis in the engine of the Old Continent’s economy.

Spain is his “special pick”, although he has also favored Italy this year.

They are moving away from France

Then there is France, once seen as a mirror image of Germany in terms of economic power, but now shunned by many investment funds.

Investment sentiment deteriorated last year after reckless public spending left it with the largest deficit in the eurozone.

The government’s efforts to pass the 2026 budget in the coming months could trigger a new wave of volatility.

As a result, the difference in borrowing costs between France and Italy has narrowed: investors are asking just 12 basis points more to lend to Italy for 10 years than to France — the smallest amount in two decades.

Stability…

In a speech in June, European Central Bank official Philip Lane noted the relative stability of eurozone bonds this year, even as other debt markets have seen sharp fluctuations.

That’s likely due to factors such as inflows from domestic and international investors reducing their exposure to U.S. assets, as well as a “shared commitment” to fiscal responsibility across the bloc, Lane said.

Of course, regional bonds have already risen so much that the potential returns are no longer as attractive as they once were.

Greece is a case in point — less than three years ago, its 10-year bonds were yielding more than 5%. That has since fallen to around 3.30%.

However, there remains some – reasonable – reluctance among American investors to move into European government debt markets beyond German bonds, which are still considered the region’s “safe haven.” However, it is difficult to argue that the countries of the region will return to the “slow lane” of growth, unless there is a new economic crisis or a sharp fiscal deviation.

Ales Koutny, head of international fixed income at Vanguard, said that while demand from the U.S. has increased, German bunds have attracted “the largest share” of inflows. But it’s hard to argue that the periphery will return to the “slow lane” of growth unless there’s another financial crisis or a major fiscal misstep, according to Marvin Hill, a senior fellow at Royal London. Kristina Hooper, head of market strategy at Man Group Plc, says that — with the right valuation — there are plenty of opportunities beyond the traditional core. “It’s time to diversify, even modestly, from the U.S.,” Hooper said in New York. The periphery “is doing well and their bonds are looking much more attractive than they used to be,” she added.

These and other tales for virtuous investors and for traders who want good commissions… Let’s always look at the fundamentals!