For 49% of fund managers, gold is the most crowded investment (i.e. when many investors adopt a particular strategy). This is the first time in 2 years that the Magnificent 7 technology stocks have lagged in the research on investment strategies.

However, there is a problem. These fund managers clearly do not know much about the gold market. The assumption is that they have not positioned their clients properly for the rise in gold and are currently on the other side of the fence. Gold is not part of a crowded strategy in any way, as we will show.

Central banks are driving this bull market in gold. Retail and institutional investors have barely gotten involved (yet). We can see this in several ways.

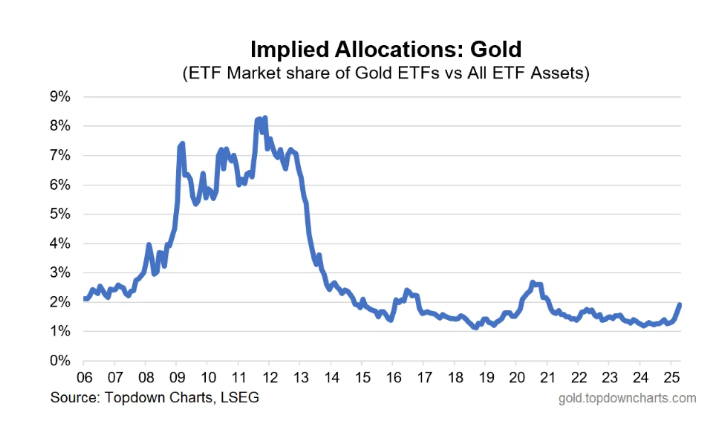

1. The first is by looking at the chart below, which shows the percentage of all ETF assets that are comprised of gold ETFs (such as GLD and PHYS).

So only about 2% of ETF assets are currently allocated to gold. And during the last bull market, in 2011, that number reached over 8%. Here’s another interesting tidbit.

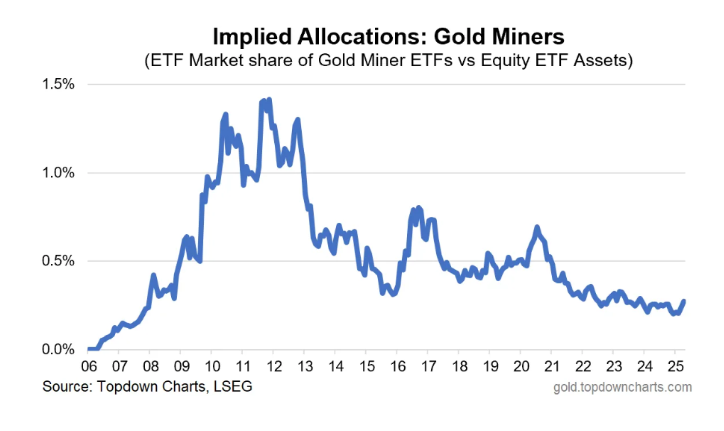

2. Gold mining ETFs are even more under-invested than gold mutual funds. Below is another chart showing the market share of gold mining ETFs.

As you can see, gold mining ETFs only make up about a tiny 0.25% of all stock ETFs. In 2011, they were almost 1.5%.

3. Almost no one is investing in gold and silver mining rights today. It’s a fraction of the rounding error of the overall market. So, no. Gold is not a Wall Street investment trend.

The current gold market is not being driven by retail and/or institutional investors. The vast majority of the buying today is being done by central banks. If anyone has already bought gold (and silver), you’re way ahead of the curve.

A Different World Has Emerged

We need to consider how market conditions have changed since 2011.

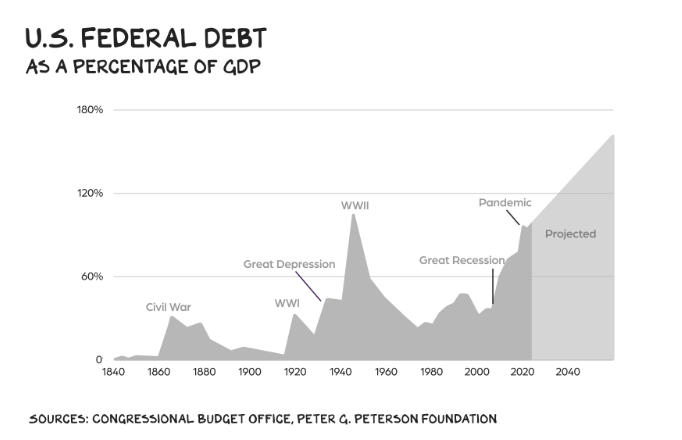

- The global burden of public debt is much, much greater.

- In 2011, the US federal debt was about $14 trillion.

- Today it is over $36 trillion and growing at a much faster rate.

- Meanwhile, China, India, Turkey and Russia are gobbling up an ever-increasing share of global gold production.

As is well known, it is entirely possible that China’s gold reserves now exceed those of the US by a factor of 2 or 3. And just recently, retail interest in gold in China has exploded. The thing is, it’s a completely different planet than it was in 2011.

The major asset managers haven’t gotten the message yet. But they will eventually. For now, they just see gold as an “oversold” asset because the price has gone up. They have no idea that central bankers are the ones playing the game.

This is the ultimate insider signal when the guys who run the printing presses for fiat currencies are the ones buying gold. The fact that central bankers are doing the bulk of the gold buying today is significant for a few reasons.

1. First of all, they are unlikely to ever sell it in this century.

When central banks make a change to their reserve policy, it tends to last at least a few decades. This trend will continue into the future. When mainstream investors finally get into the precious metals game and start to digest the magnitude of the situation, the precious metals move will be absolutely explosive to the upside.

Everyone will rush to buy gold bars and mining rights so they can answer their clients’ questions about why they are not participating in the precious metals bull market.

We have only recently started to see a small increase in gold and silver miners, this is really just the beginning of this move.

2. In the very short term, it looks like gold is expecting a break in the bull market.

It could fall to around $3,000 or a little lower. Then, continuing higher, with $4,000 being a reasonable target for the end of this year. But who knows, we could just keep marching forward as central banks and smart investors continue to gobble up gold to prepare for the chaos that follows.

The Change – After the Tech Fever…

In recent years, the world has seemed to be infected by a… common strain of tech fever. Symptoms of the disease include buying stocks at 50 times the company’s earnings, chasing a handful of big names at ridiculous prices, and believing that the bull market can last forever.

This particular type of tech mania has been around for centuries:

- Railway mania, England 1840, USA 1860 – 1870

- Electricity and communications (telephone) boom, USA 1880 – 1900

- Internet boom and bubble, USA 1990 – 2000

Technological innovations change, but human behavior never does. It starts with real technological breakthroughs and grows into a frenzy that occasionally spirals out of control. Only the strongest companies survive, and even those almost always crash hard toward the end of a bull market.

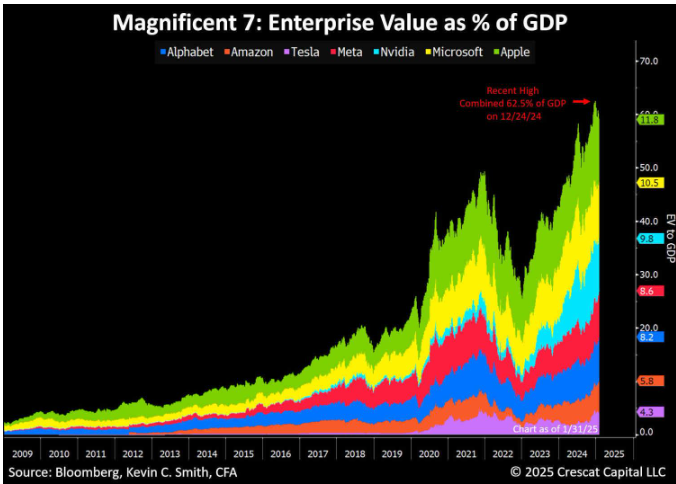

The current bubble in tech stock prices has become so extreme that the so-called Magnificent 7 (Apple, Nvidia, Alphabet, Meta, Tesla, Microsoft, and Amazon) were worth, near their peak, a remarkable 62% of U.S. GDP.

We have almost certainly already seen the peak of technology for this cycle. For those who are savvy enough to profit from technology, where will they move their capital now?

A new gold rush. The world is changing. What worked best for the past 15 years (technology) is unlikely to repeat itself in the next decade, and what’s more: A debt crisis is looming.

In the US, President Donald Trump and Elon Musk seem to be hitting a wall when it comes to cutting spending. They are making a valiant effort, but the Washington swamp creatures have extremely strong defenses.

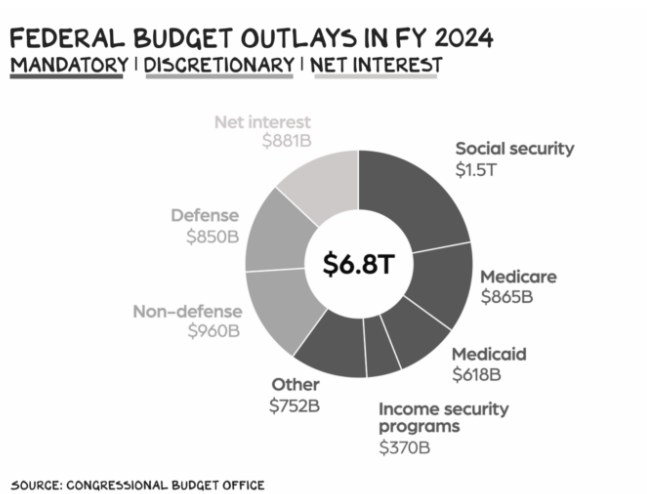

In addition, President Trump has rejected his idea of cutting military spending by 50% and now plans to increase it even further. Even if the US balanced its budget this year (which it won’t), we would still have more than $36 trillion in debt that costs more than $1 trillion in annual interest and amortization. Those costs will rise rapidly from here on out.

The Sharp Deterioration of the Fiscal Position

A recession is almost certain at this point, and that will put even more strain on government budgets.

Aid checks, tax cuts, and QE (massive money printing) are all in play for governments to deal with the intense social protest. And let’s not forget the off-budget obligations, which America has promised to beneficiaries of Social Security, Medicare, Medicaid, and other programs.

Estimates of these “unfunded liabilities” range from $70-150 trillion over the next 50 years. That’s an incredibly large amount of money. And the bill is coming.

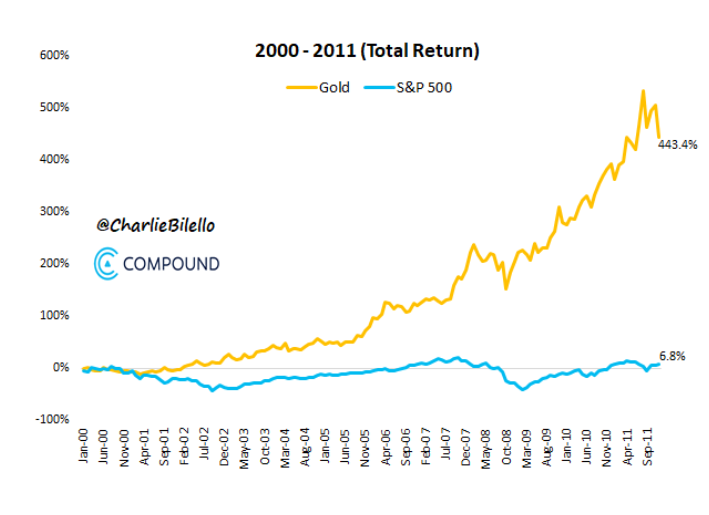

As a result of this chaotic situation, a shift towards precious metals has begun – a monetization of them in the face of a quasi-economic war to preserve asset values. The trend has only just begun. The fascinating chart shows gold’s performance against the S&P 500, from 2000 to 2011.

While gold has returned an impressive 443% during this period, gold mining stocks have fared even better, posting gains of around 700%.

Over the past 5 years, the largest gold mining ETF (GDX) has done well, but it is still only up around 68%. There is still a lot of room for upside.

Furthermore, we must consider that from 2000-2011, the US was in excellent economic shape compared to what it is in today. So the outlook for precious metals is much better than it was then.

A significant shift in investment choices away from technology and bonds and towards precious metals is underway. It may seem like gold has reached an all-time high, but history tells us otherwise.

There will certainly be upheavals in the precious metals market, but these should be viewed as buying opportunities. America will face a major financial and economic crisis in the coming years.

President Trump and his team are working to address the fundamental issues, but these problems will take decades to address, not months or years.

In the meantime, precious metals remain the safest place to invest. The upside is excellent (especially for mining rights and silver) and there is no other sector that will benefit as much from the inevitable chaos over the next decade.