Despite the shockwaves caused by Trump’s tariffs, the headlines – as usual – are wrong about the causes of the market volatility and the implications that lie ahead.

Understanding how to navigate such market pressures, the historical reality of debt, the role of gold and – most crucially – the significance of a liquidity crisis requires a much more balanced approach than “blame the tariffs.”

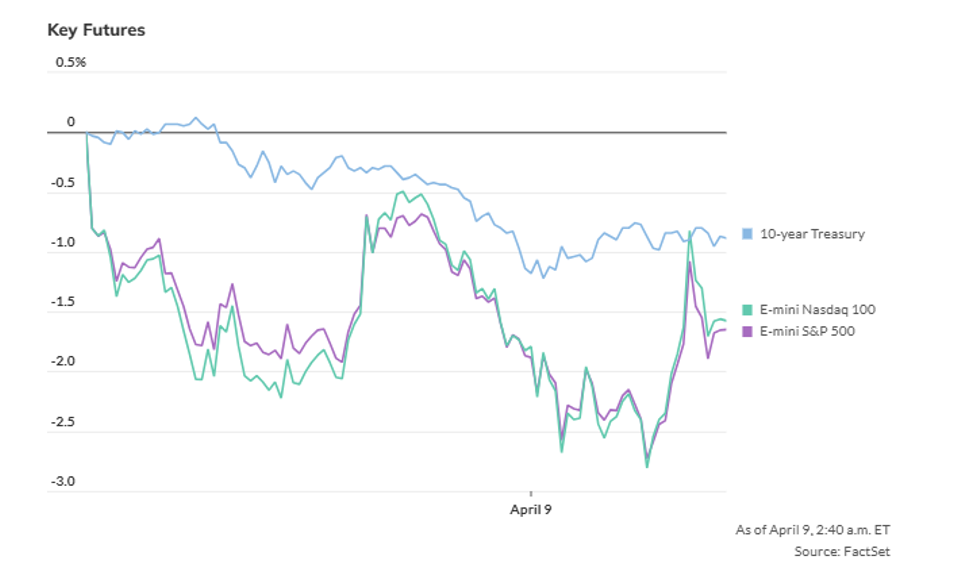

At the time of writing, the reaction of risk assets to Trump’s “Liberation Day” of tariffs has been anything but positive: the VIX has shot above 50, while stock indices have turned red. The S&P index has lost 11.5% in three days, while the yield on the US 10-year Treasury is at 4.38%, which shows that Uncle Sam’s “bill” is no longer functioning as a safe haven.

Are tariffs to blame?

According to Trust Economics, the public, along with the financial media, blame the market meltdown on tariffs—which misses the point and the big picture by trillions.

The stark truth about this carnage is that U.S. stocks were long overvalued, artificially inflated by the Fed, and were a red balloon just waiting to burst. And there were many possible triggers: war, a bank collapse, desperate interest rate moves, unforeseen political events, or simply the weight of a mean-reversion from a market bubble.

Yes, tariffs were a big trigger—but they weren’t the root cause of what investors are experiencing now and what citizens—regardless of the markets—have been enduring for years.

In January 2024, Trust Economics expressed its pessimism over the “Pavlovian” markets getting excited about expected Fed rate cuts. Just a year later, we were openly cautious about 2025. Fortune-telling skills? None.

The “smart money” had already turned to cash, as markets became overly dependent on a handful of overvalued companies in a changing environment—de-dollarization, de-globalization, and a disruptor in the White House. Those January predictions weren’t magic: they were an acknowledgment of a debt cycle approaching a painful but inevitable tipping point.

Debt Tells Us Everything

For anyone seeking clarity on asset trends, the implications of tariffs, the direction of currencies, recessionary forces, the path of precious metals, and the general nature of the new global disorder, one need only pay attention to a four-letter word: DEBT.

Debt—and its unprecedented size, risk, and trajectory—is a theme that consistently surfaces in almost every Trust Economics analysis.

From debt crisis to stock market crisis

- A debt crisis = a credit crisis, leading to

- a credit crisis = a liquidity crisis, which in turn

- a liquidity crisis is the cause of every market crash for centuries.

The math, the history, and the direction of today’s credit crisis were obvious long before the headlines discovered tariffs as the trigger. For years, Trust Economics has been warning about the clear and blatant signs that the US is on the verge of bankruptcy and that the credit crisis is not just coming – it is already simmering all around us.

The ignored signs

- There was the repo crisis in 2019, when even the big banks didn’t trust each other’s collateral, and the Fed was forced to refinance them with billions at the click of a mouse.

- A year later, came the so-called COVID crisis in March 2020, which was essentially another liquidity/credit crisis, followed – as you might expect – by unlimited (i.e. trillions) of inflationary money.

- By 2022, thanks to Powell’s failed “war on inflation” with “higher for longer” interest rates, US markets had seen their worst nominal returns on stocks and bonds since 1871. Why? Because the Fed’s rate hikes triggered another credit and, by extension, liquidity crisis.

- In 2023, we saw three of the four largest bank failures in US history – again, not because of the banking system, but because of US government bonds.

In other words, another Credit Crisis, “solved” with yet more trillions of “digital” inflationary money. See the pattern? A balloon desperately searching for a needle?

Liquidity Crisis

Connecting the dots, it becomes easier to see how a nation with a 125% debt-to-GDP ratio ($37 trillion) is becoming less and less creditworthy – with fewer buyers for its government IOUs.

That means less credit and less liquidity to keep the economy going. In short: trouble. And when this already indebted, discredited nation chooses to weaponize its currency and its government IOUs, is it any wonder that demand for U.S. Treasuries has collapsed?

In other words, all these forces are converging and forming a clear roadmap toward a liquidity crisis – the consequences of which were already underway before the media blamed tariffs for the latest disruption.

The Tariff Perspective

When it comes to tariffs, we at Trust Economics – and many others – have spoken at length about their nature and risks, so there’s no need to rehash the details or feign surprise, as the markets and the media do. No surprise here.

Certainly, a 10% base tariff on all imports, along with 20% on European imports and a whopping 104% on Chinese imports, is set to shake up everything – from global markets and geopolitics to the average American citizen.

And as for the average citizen? No illusions: these tariffs will be inflationary and painful, as the US is running its largest merchandise trade deficit in its history.

Fighting inflation… tearing everyone apart

The (supposed) good news? Prices may fall despite the increases – because demand collapses. How? Here’s the bad news…

If the tariffs trigger a recession or worse (see McKinley era), and Americans – already bankrupt – start buying less, then the demand destruction will push prices down.

And a deflationary market crash and the liquidation of your pensions (401k) can also “fight inflation” – but that victory will come at your back. We’re just mentioning it.

And in the end, the Fed’s inevitable liquidity “bazookas” will send inflation soaring again and the dollar to its nadir. All roads – dedollarization, Fed desperation, unsold Treasury bonds, trade wars – eventually lead to inflation.

The Facts

At the same time, the media and the stock market (as well as 99% of politicians who know next to nothing about economics or history) have forgotten to mention this: You are already living in a consumer recession – and have been for a long time. Do you need proof?

Beyond the “boring” data on

- the yield curve,

- the changes in M2,

- 24 consecutive months of leading indicators that underline that a recession is coming,

- the highest rates of small business bankruptcies in the last 13 years,

- record delinquencies on credit cards and auto loans,

- the Oliver Anthony index,

- the 2024 employment data (after the election) that was 880,000 jobs short,

- and the unemployment rate increased by 50 basis points in 12 months…

- the US has been experiencing negative retail sales for months,

- while consumer spending (excluding Amazon) is at almost zero.

But obviously, such blatant recession indicators meant nothing while the stock market was rising.

Capital Markets are no longer hiding the truth

But now that the rally is over, analysts, politicians and traders who were swept up in FOMO are starting to look confused, worried – even surprised. Surprised?

With all the above data, numbers and rising bond spreads, how is it that the debt crisis, credit crisis and now liquidity crisis are a surprise? For those who have been paying attention, it is not.

In this context, according to Trust Economics, since every debt crisis leads to a credit crisis, a liquidity crisis and then a market crisis (and recession), the future – however uncertain – can be predicted with relative certainty.

Simply put: Failed systems, markets and states need more liquidity. But how? Ideally, we should have more productivity, tax revenue, and a net trade surplus than we have debt, liabilities, and deficits.

Trump’s spending cuts, the elimination of USAID, and even tariffs (good or bad) are not going to bring about any surplus or economic miracle – not now, not anytime soon. No one can save the US from the inevitable and necessary creative disaster that is coming.

Instead, as history shows, the US will do what all bankrupt states have done in the past – namely, inflate its debts through economic repression, before imposing capital controls and a covert concentration of power, under the guise of “the common good.”

Predictable acts of desperation

Also predictable is the creation of a speculative bubble via a “strategic BTC reserve” so that the artificial profits go to repaying debt like… El Salvador.

Another “trick”: Regulations that would peg crypto and especially BTC only to the dollar and stablecoins backed by UST/USD – thus creating a new “petrodollar” for supposedly decentralized digital currencies.

This will increase demand for dollars and USTs, but it will be very bad for individual liberties. No surprise.

Even more predictable is the inevitable pivot in the near future from tightening (QT) to quantitative easing (QE), when the markets collapse. This means more “money at the click of a mouse” – inflationary – after a deflationary market crash and an official (rather than denied) recession.

After that, the failed leadership will likely turn to a “reset” already heralded by the IMF, where a CBDC partially backed by gold becomes the norm in a world of increasing disorder.

Gold

- And what do all these “solutions” to the debt, credit and liquidity crisis have in common?

- What does the failure of USTs and their demand mean?

- What happens when the former buyers of our debt become sellers? China is now a seller…

- What does it mean when the global south (BRICS etc.) settles trade in gold, and when oil is sold outside the dollar?

- Why are we seeing record gold purchases by central banks since the US weaponized the dollar?

- What does it mean when even the BIS declared gold a Tier-1 reserve asset, above the once-sacred USTs?

- What does it mean when central banks have been dumping USTs and buying physical gold for a decade?

- What do the physical gold outflows from the COMEX show?

It’s simple: Gold is the new – and inevitable – safe haven in a world that is losing faith in defaulted securities, inflated currencies, in uncontrollable debt, and in markets that are violently reverting to the mean due to the apparent liquidity crisis.

In this context, isn’t it time to do what your governments refused to do? That is, to protect your own currency with the only true money of nature, history and common sense: gold? Decide for yourself – Trust Economics.