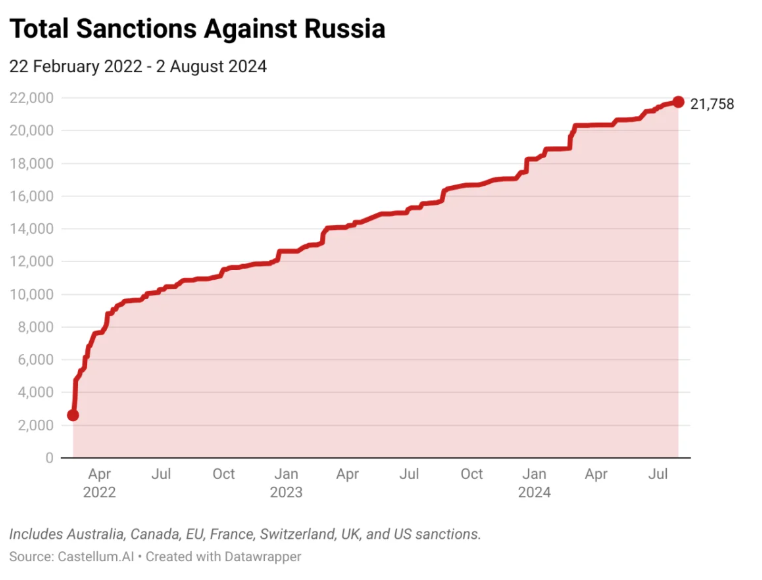

Bitcoin and the BRICS group are seen as weapons to reduce Russia’s dependence on the dollar, according to President Vladimir Putin’s monetary strategy.

- Russia has launched international transactions via Bitcoin with the aim of exploiting the benefits of the alternative monetary regime of digital currencies.

- Russia is counting on digital currencies to promote international trade in ways that can protect it from US sanctions and remove the dominance of the dollar in trade transactions.

- Russia is trying to wean itself off the US dollar, especially due to international sanctions from the United States.

- This makes it challenging for Russia to trade with other countries, because most transactions worldwide are still conducted in dollars.

- Russia is therefore exploring alternative means to replace the dollar, one of which is Bitcoin and other digital currencies for making international payments.

- Russia is looking for other ways to regulate its trade balances with third countries and bypass the US banking system, which leaves it vulnerable to freezing or blocking transactions. It finds such alternatives in the Chinese yuan or even Bitcoin – purely electronic money that is extremely secure and, therefore, easy to exchange.

- Russia needs the BRICS group of countries more as a solution to protect itself from US economic warfare than to challenge the status of the dollar.

- The Russian economy is not strong enough to replace the dollar as the main world currency. The move is merely symbolic, it is a reaction against the sanctions that have cut it off from global finance.

Due to the inability to access the global financial system and international markets, Russia has to choose alternatives, such as trading in local currencies of allied states and even using its gold reserves. The whole transformation is not about getting rid of the dollar completely, but Russia is trying to be more self-reliant and less vulnerable to further economic pressures.

What would this mean for Russia?

Switching to Bitcoin, the BRICS currency, or digital currencies would be helpful for Russia’s economic independence, avoiding US interference in its trade and reducing its dependence on the US financial system.

However, there are some challenges

Not all countries are ready to use Bitcoin, and not all trust digital currencies. Bitcoin’s security issues and large fluctuations in its value are also part of the challenges. If Bitcoin or the BRICS currency becomes a major means of payment, Russia needs to create a strong support system and educate its businesses and people on how to use digital currencies safely. And there is also speculation that Russia will soon start converting its foreign exchange bills to Bitcoin in order to avoid asset seizures like the ones that have occurred recently.

What does it mean for the US?

Russia’s move away from the US dollar would be a global issue.

The dollar is used for major international trade and as a store of value, making the US a hegemonic economic power with “weapons” such as sanctions. The ruble (RUB) is weaker compared to the US dollar and is not commonly used in international trade. This has allowed the US to exert significant control over global trade. If countries like Russia were to use Bitcoin for transactions instead of the dollar, it would potentially allow the country to bypass sanctions.

Global Impact

With more countries, including Russia, embracing Bitcoin, international transactions could become cheaper and faster as it eliminates the need for banks or middlemen. On the other hand, Bitcoin’s price is volatile and could cause economic uncertainty in the future if it is used as a primary currency.

Also, since many countries do not fully regulate Bitcoin with a specific regulatory framework, this leaves a lot of room for fraud such as money laundering and concerns about the security of transactions.

Russia is also trying to use Bitcoin in international trade and make digital currencies more accessible. It is unlikely that the dollar will be replaced by Bitcoin in the near future, because Bitcoin is still unstable and not accepted everywhere for regular transactions. While Russia aims to reduce its dependence on the dollar, Bitcoin’s volatility and lack of infrastructure to support it make it a risky alternative. If more countries follow suit, we could see a gradual shift away from the dollar, but it remains the dominant global currency for now.

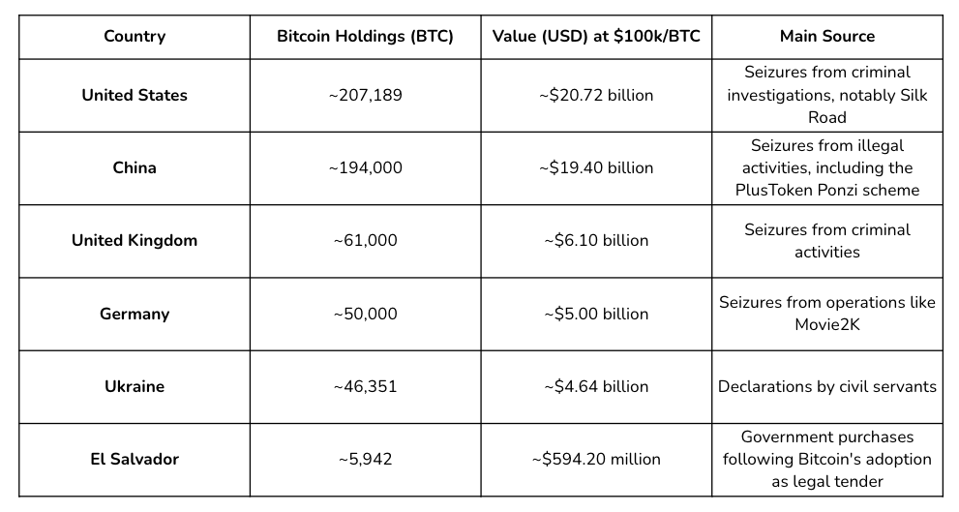

United States: Strategic Accumulation Through Seizures

The United States is currently the largest holder of Bitcoin, with an estimated 207,189 bitcoins. This vast stash is valued at over $20 billion at current prices.

The U.S. government’s Bitcoin holdings have been acquired primarily through asset seizures from various criminal investigations, most notably the Silk Road case. The U.S. government recently transferred 20,000 Bitcoins worth $1.9 billion to Coinbase Prime, according to Arkham Intelligence, signaling active management of its holdings.

Despite these transfers, the government still holds a significant portion of its Bitcoin assets, with discussions ongoing about potentially using these holdings as a strategic reserve or to address a national debt that is close to surpassing $36 trillion.

Germany: The … lessons from selling Bitcoin

Germany’s 2022 Bitcoin sale stemmed from the dismantling of Movie2k, an illegal website whose operators were laundering millions via Bitcoin. Authorities seized the cryptocurrency and sold it, citing legal requirements for converting assets to fiat and a preference for immediate liquidity over market risk.

While the sale generated significant revenue, critics argued that holding Bitcoin could yield greater long-term gains. This reflects Germany’s cautious stance on cryptocurrencies, prioritizing fiscal stability over speculation.

Comparison of National Bitcoin Holdings

Nations’ Bitcoin holdings are often shrouded in mystery, but public data provides a glimpse into this emerging trend. Most holdings come from seized transactions, highlighting the legal complexities and opportunities in managing digital assets.

Table summarizing the largest national Bitcoin holdings:

- Prices are calculated based on a Bitcoin price of $100,000 per BTC.

- Germany’s holdings are based on the recent seizure by Movie2K, but were sold in full in November 2024 at an average price of $57,600 per Bitcoin.

- El Salvador’s holdings come from government purchases, as it made Bitcoin legal tender.

- Bhutan’s holdings reflect a unique approach through state-owned mining operations.

The Road to a National Bitcoin Reserve

The geopolitical landscape regarding Bitcoin usage continues to evolve. While the US leads the way in holdings, states like China and Russia are quietly building up their reserves, often through opaque channels to meet current funding needs amid sanctions.

Meanwhile, smaller players like El Salvador are showing how digital currency can transform national monetary strategies. The real race for Bitcoin reserves will likely intensify in line with existing economic and strategic opportunities. Wealthy countries with huge foreign exchange reserves, such as the United States and China, could leverage their economic power to acquire vast amounts of Bitcoin.

In a hypothetical scenario where nations allocate the equivalent value of their gold reserves to Bitcoin, the market would experience unprecedented demand, with the price of Bitcoin expected to exceed $952,000 and the total market cap to reach around $20 trillion.

Mid-sized powers like the United Kingdom and Germany may increase holdings through aggressive seizure policies or outright purchases, aiming to provide a hedge against financial instability.

Countries with significant technological infrastructure, such as Japan and South Korea, could bolster their reserves through government-backed mining initiatives, similar to the model adopted by Bhutan. Meanwhile, countries like Russia and Iran may focus on state-sponsored mining to circumvent sanctions and secretly acquire Bitcoin.

“Digital Gold” and the New Economic Paradigm

If nations begin actively accumulating national reserves of Bitcoin on this scale, the world could witness the dawn of an era where “digital gold” replaces traditional assets in national accounts.

This shift would mark a moment of major transformation in economic history, as Bitcoin’s unique properties—decentralization, finite supply, and immunity to inflationary pressures—challenge the dominance of fiat currencies like the dollar.

The unprecedented demand for Bitcoin would shape a new economic paradigm, redefining how nations store and utilize wealth.

The Geopolitical Implications

This movement could also have profound implications for the geopolitical order. Smaller, financially flexible states may gain a competitive advantage by adopting Bitcoin early, leveraging it as a hedge against inflation and as a tool for economic empowerment.

In contrast, larger economies will face increasing pressure to incorporate Bitcoin into their reserves to avoid losing influence in a changing economic landscape.

As Bitcoin becomes an integral part of national reserves and treasury holdings, it could reduce reliance on traditional financial systems and institutions such as central banks, changing the dynamics of international trade, diplomacy, and negating the power of sanctions within the international order defined by American hegemony.