Liberalism considers the security of property sacred. The traditional refuge of all is gold. But has there been a revolutionary change that gives us an alternative solution?

And of course we are referring to bitcoin. Many criticize the protocol without fully understanding how it works, despite the fact that they understand the need for sound money. According to all indications bitcoin could eventually receive a standard monetary status after the next financial crisis that will uproot the old monetary regime.

If someone works hard and the only thing he wishes is to preserve his wealth, he has as his opponent monetary policy which controls the production of value.

Legitimate monetary policy nevertheless produces $2 trillion in deficits and unserviceable debt. So anyone who wants to be out of this rigged system and is outraged by the Occupy Wall Street movements, the escape route could very well be Bitcoin for a number of reasons.

Why is it an emergency exit?

Bitcoin is much better than going out into the market and indulging in GameStop-style speculation because there is no counterparty. Therefore, one does not have to worry about someone else not responding to the transaction request. No one can stop transactions, no one can expropriate Bitcoin.

There is no risk of its value collapsing because no one is going to come out and issue more – overinflating the supply like central banks do with fiat currencies, and it is, in essence, a way to get out of the system.

The system of fiat currencies (those issued by central banks) is already rigged and the path is pretty much known. The quality of life of citizens is reduced due to the fiat system.

For example, someone works a grueling 40 hour week, and can’t afford a Domino’s pizza because of the fiat currency system. So you can get out of the fiat system in a number of ways.

Gold is the first preference, but Bitcoin could also work.

What happens when the stake is raised? When 5,000,000 miserable hippies who lived in tents during Occupy Wall Street, combined with the two million people who still walk with Ron Paul join together and join the Bitcoin network?

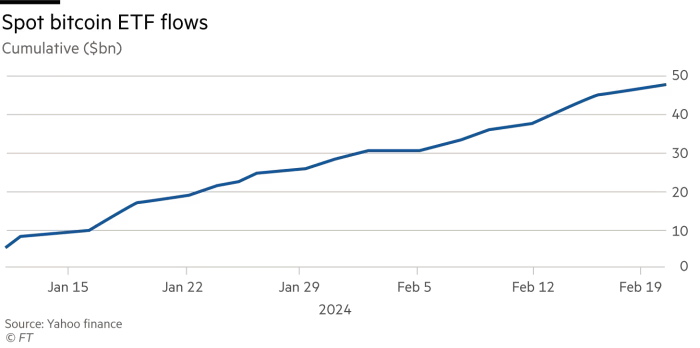

After bitcoin ETFs

Bitcoin ETFs are essentially a tacit blessing from regulators. There is no going back. You know, it’s not like the next government is going to come in and say, we have to delist ETFs. That’s just never going to happen.

So now, the question is, okay, you’ve opened the funnel of the RIA trading opportunity, which is going to be a few trillion dollars in Bitcoin. Bitcoin’s market cap is still at one trillion dollars or $900 billion.

Foreign inflows

We’ve added to our predictions about foreign currency and other nations flocking to invest in bitcoin:

At a conference that just happened in Dubai last week where you see like all these super rich people and we don’t mean someone with a nice mansion in New Jersey and a Mercedes-Ben or four Bugattis and a pet tiger.

- This is wealth on a different level.

- This is the wealth of Saudi Aramco.

- I mean, I live above an oil rig.

- These people are just looking for something to do with their money.

- They have more money than they know what to do with.

- They gild water slides in water parks and build entire cities in the middle of the desert.

- If anyone thinks that some of these guys aren’t going to put $20 billion, $25 billion on their government balance sheets in the Middle East even if they risk losing all their money, they probably have no idea.

- They want to be on the next wave, whatever that is.

They don’t even have to understand it. So, it’s almost better that they don’t get it. You know, they just say, “Okay, well, it’s this fancy thing. We want to get some of it. We might hold a trillion dollars in gold, $10 billion in Bitcoin. But I think when things like that happen, the theory of games simply undertakes to study the situation.

Many have called this an unprecedented experiment in monetary policy. It has never happened before. And so, is it really paradoxical to think that we will have an unprecedented result? No it is not.

So, what does an unprecedented result mean? It means that something will happen which will be unexpected. We are in uncharted waters.