Europe, led by the Brussels elite, is experiencing a summer of submission while the absolute winner of a double trade and geopolitical war is US President Donald Trump: Finis Europae, this is the death knell of the once powerful superpower.

The prospect of a transatlantic divorce seemed to be hanging in the air from the beginning, as the future of Ukraine, NATO and bilateral trade relations were aggressively put in doubt by Trump.

The US president – who called NATO an obsolete institution, promised to end the war in Ukraine within 24 hours by removing Europe from the negotiating table and characterized the EU as an adversary – has forced the Old Continent into complete capitulation.

Europe was forced to back down in disarray and pay — not one, not two, but three bills.

1. First for NATO, pledging to spend hundreds of billions on defense and security.

2. Then for Ukraine, taking on the responsibility of paying the US for weapons that Ukraine needs.

3. And finally, on trade, allowing the US to unilaterally increase tariffs, even as Europe promises to buy more than 1.35 trillion in US energy and arms, as well as investments on American soil.

This is a complete reversal of the balance in the EU’s bilateral relations with the world’s largest economy compared to the post-war treaty, with the Old Continent being relegated to the background – at the level of… Canada or Mexico!

The US believes that it will negotiate the future of global trade with China and the other major economies will simply follow.

Trump announced that from April 2, 2025, a new 20% tariff will be imposed on all European imported goods, a huge increase compared to the tariffs at the time, even after the final reduction of this amount to 15%.

The increase in tariff rates

Note that before April 2, the European Union had tariffs averaging 5.1% (simple average) or 3.0% (trade-weighted), while the US had an average of just over 1%.

The average tariff rate imposed by the United States was 3.4% before April 2, 2025 according to the World Trade Organization, while Trust Economics estimates that the average US tariff rate will rise to 15.8% from 13.3% — significantly higher than just 2.3% before Trump took office.

Data Analysis: Trust Economics – Editing: The Liberal Globe

The $1.7 – $2.0 trillion bombshell

Let’s do some rough calculations (because the data on trade flows is fluid): The US trade deficit with Europe in 2024 was $ 236 billion, while imports from the EU were $ 606 billion. With tariffs at an average of 3% (together with sectoral agreements that raise the trade weighted average tariff to 2.4%) the US would collect over $ 18 billion while now it will collect over $ 90 billion (on an annual basis), about $ 73 billion more, or an increase of 443%!

If we add the $ 1.35 trillion in energy and weapons imports and investments in tariffs (90 billion on an annual basis) of $ 360 billion over four years we have 1,710 trillion dollars transfer of resources from Europe to the US.

The bill, together with the commitment of amounts for Defense from the national budgets of the EU member states, will reach close to 2 trillion dollars.

It should be noted that the Commission’s proposal for the Multiannual Financial Framework 2028-2034, the long-term budget presented on July 16, has a total cost of 1.816 trillion euros, an amount considerably higher than that approved in 2020 for the period 2021-2027 and which amounted to 1.21 trillion euros.

As the resources from the net contributing countries (mainly Germany and Britain) are not sufficient, the European Commission has even proposed a “green” tax, a corporate tax and other measures that have caused strong reactions in order to increase its revenues.

What does the trade deal include?

- The EU will buy $750 billion worth of goods from the US and invest an additional $600 billion in the US economy

- “Huge quantities” of US military equipment

- Opening up European markets to US products

- 15% retaliatory tariffs

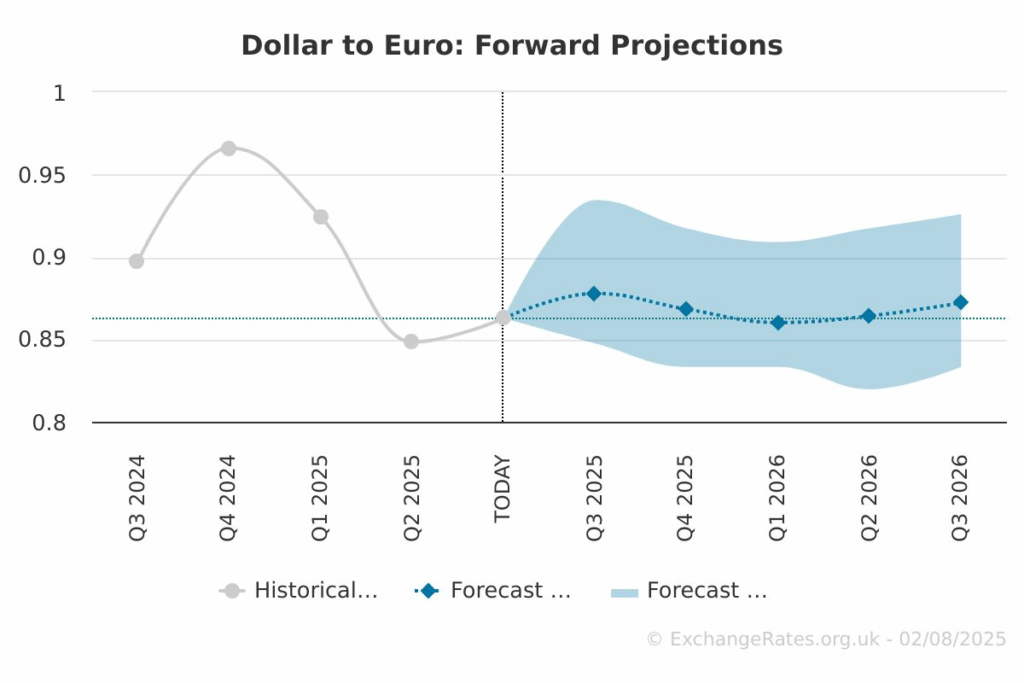

Meanwhile, the dollar has depreciated by 7.3% against the euro since April 2 (about 13% since the beginning of the year), which means a significant reduction in the competitiveness of European companies. Commission President Ursula von der Leyen acknowledged that this tariff “will be a challenge for some industries”.

Indeed, it may erode the competitiveness of some European sectors compared to their American counterparts, the head of the European Commission admitted.

Trump Achieved All His Goals

Trump achieved all of the goals he set for Emancipation Day: (a) Immediate increase in tariff revenue that will reduce budget deficits. (b) Improvement in the current account, by reversing the negative trade balance with major partners. (c) Rebuilding the competitiveness of American manufacturing combined with the depreciation of the dollar and bringing jobs back to the United States.

The background to the agreement

Both leaders agree that the agreement covers the auto sector, something Germany strongly desired as its auto industry was threatened, since until recently European automakers faced a 25% sectoral tariff.

Trump said that “European countries will open their markets with zero tariffs.”

In addition, airplanes and spare parts will be exempt from tariffs, while according to Von der Leyen, pharmaceuticals and semiconductors will be subject to the new 15% tariff, thus protecting them from sectoral tariffs that could reach 200% — as Trump had threatened.

However, before the meeting, Trump had stated that pharmaceuticals would not be included in the agreement (he wants to develop domestic production and sharply reduce prices).

Other American officials seem to confirm Von der Leyen’s version, but a final agreement has not yet been signed.

Energy, equipment and investment

Following Japan’s example, the EU is essentially just expressing relief (!) as it was spared even higher tariffs.

It agreed to buy $750 billion worth of American energy by the end of Trump’s term — a multiple of the $65 billion of total U.S. energy imports in 2024.

Even if Europe were to meet all of its demand for diesel and LNG from American sources, the goal is considered overly ambitious and conflicts with Europe’s strategy of diversifying its suppliers.

The EU also pledged to buy large quantities of military equipment, which meets existing needs — although countries like France would prefer defense production to remain in Europe and have called the deal counter to Europe’s interests.

Also notable is the commitment to invest $600 billion in the U.S. For Trump, this is a clear victory, as is obvious.

If these investments come from European companies, they will lead to a transfer of productive activities outside the EU in addition to the transfer of resources.

If they come from European states or institutions, they will have to compete with internal investment needs, in a period of budgetary constraints.

German defense machine brings bleeding and debt crisis

The most significant European development is Germany’s reemergence as a military player, with a five-year investment plan of more than 600 billion euros for defense and security. But it is telling that the Merz government is adopting a “Made for Germany” philosophy, sidelining the opportunity to put the country at the center of a coalition that could form the backbone of a future European defense union.

Similarly, the recent Lancaster House Agreement between Britain and France is an old-fashioned bilateral entente industrielle, allowing both countries to maintain national power in a “Europe of security and defense” — but not a cornerstone for a broader European project.

Germany is preparing to double its annual defense budget to 162 billion euros ($189 billion) by 2029, a major strategic shift as the country ramps up its military as a smokescreen for perceived growing threats from Russia.

The planned increase includes 9 billion euros a year to support Ukraine and would take defense spending to about 3.5 percent of GDP, well above NATO’s 2035 target, Bloomberg News reported Monday, citing a senior government official.

Germany currently spends 2 percent of GDP on defense. This increase marks a dramatic change of direction for the country, which has traditionally been cautious about military involvement since World War II.

Finis Europae, no plan

The EU cannot hide the fact that the Trump 2.0 administration has forced it into submission. The world’s leading multilateral free trade bloc has failed to defend trade – an oxymoron as the Chinese are set to emerge as defenders of the free economy.

The President of the European Commission, Ursula von der Leyen, has gone so far as to portray Europe as the “dragon of the fairy tale”, echoing Trump’s zero-sum narrative on trade.

The European Union has taken advantage of zero defence spending and cheap access to the vast American market to build a post-war welfare state with its wealthy post-war welfare state.

European countries, taken together, lack the economic power, military might, and shared worldview to collectively defend shared values and interests. Europe cannot wage a trade war with the United States because it is divided.

It cannot withstand one because it is weak.

It cannot play the Trump-style game of trade deals, which combines geopolitical power and political voluntarism, within a technocratic process for which the EU is designed.

America knew this.

Now the rest of the world knows it.

The fight against industrial decline is increasingly pushing back the practice of state support, bypassing the unification of the European market as European nationalism is expected to prevail.

Mobilizing more common European resources, which could be the simplest way out – such as Draghi’s proposals that included an investment program equal to 5% of GDP or 800 to 900 billion euros – still remains taboo, as recent discussions on the next European budget have shown again (please also read the analysis titled “Why does the EU Commission ignore the Draghi report on the competitiveness of Europe?“).

Jean Monnet once said that “Europe will be forged through crises and will be the sum of the solutions adopted in them”.

The other founder of the EU, Paul-Henri Spaak, by contrast, observed that “there are only two types of states in Europe: small states and small states that have not yet realized that they are small”.

If the EU’s humiliation is to end, its leading states must remember Spaak and relearn Monnet. Europe as the generations that participated in the project of integration knew it is already dead.